Plus500 Withdrawal - Fees, Methods & Detailed Infos in 2025

CFD trading is one of the most popular forms of trading available in the current market, with many people scrambling to sign up with professional brokers that offer CFD instruments. But a large number of these brokers are either fake or ineffective. By some estimates, more than 80% of the existing CFD brokers add no value for the client. Despite this, there has been a surge in demand for reliable CFD brokers all around the world, and especially in South Africa. For those who do not know, CFDs refer to specific derivative products that you can use to speculate on various tradable instruments such as stocks, currency pairs, commodities, indices and others.

CFDs are a leveraged product and can result in the loss of your entire balance. Trading CFDs may not be suitable for you. Please consider whether you fall within Plus500's Target Market Determination available in their Terms and Agreements. Please ensure you fully understand the risks involved.

Overview:

- Minimum Deposit: $100

- Maximum Leverage: 1:30 (T&Cs apply)

- Tradable Assets: over 2800

- Regulated by: ASIC, FMA, FSA, and FSCA.

- Demo Account: Yes

Note: CFD Service. Your capital is at risk

Plus500 is one of most trusted and regulated CFD brokers in the world, offering an impressive product line consisting of CFD trading which includes forex. Individual shares, stock indices, ETFs, options, cryptocurrencies and commodities. They provide CFD trading in all of the above asset classes, coupled with an amazing collection of charting software, technical analysis tools and real-time news feeds with no commissions charged. Users can choose from up to 107 technical indicators when trading using charts, which are offered both by their mobile app and by their webtrader application.

With clients based in almost 50 countries from around the world, Plus500 is also known as one of the best platforms operating at the moment. This can be attributed to its licensing and the regulatory bodies under which it operates. They are licensed by the Australian Securities and Investments Commission (ASIC) in Australia, the Financial Markets Authority (FMA) in New Zealand and is an Authorized Financial Services Provider (FSP) in South Africa.

Many users have questions regarding the withdrawal process at Plus500 as evident from the numerous posts on trading forums. This article aims to address the Plus500 withdrawal process in detail.

How do I withdraw funds From Plus500? (How to request a Plus 500 Withdrawal)

As a user, you can only withdraw your money from Plus500 after completing the entire verification process. Since it’s a financial service provider, it is liable by law to audit all customer details before they allow them to withdraw money. Plus 500 also check the status of the user’s phone and email to check whether they are active. The details of the withdrawal process are stated in detail below.

Requesting for a withdrawal can easily be done directly from your account. To do this, click on the menu icon found in the top left corner of your screen. You will get a drop-down menu where you will find the option” Funds”. Under Funds, go to fund management and click on “withdraw”. Enter the amount of funds you want to withdraw on the withdraw page. Next, select your preferred payment method. Lastly, click on the “open a withdrawal” button to complete the transaction.

Plus500 Withdrawal Methods

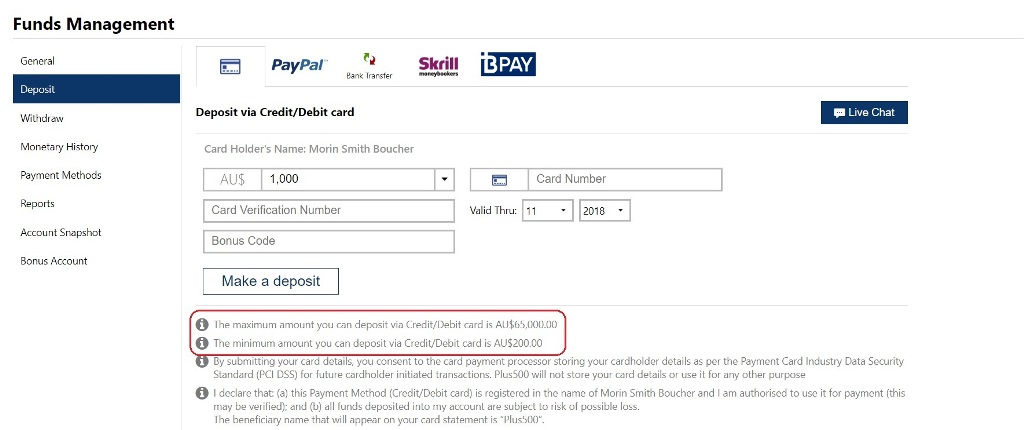

To cater to clients around the world, Plus500 accepts 10 base currencies for withdrawals, including AUD, EUR, USD and GBP. This makes it easier for many clients to trade in their local currency. This also means that traders save a lot on currency conversion fees as their credit/debit card/ provider or bank does not have to convert any currency.

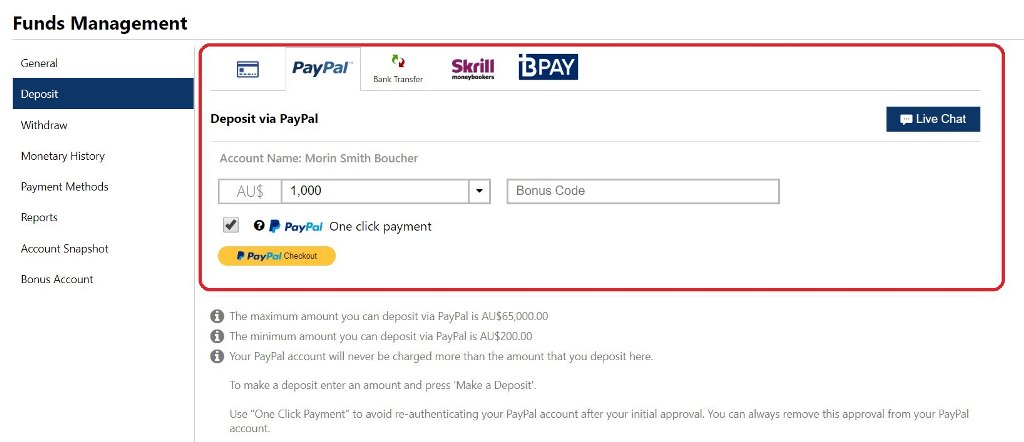

Plus500 provides several ways for users to accept the withdrawn funds. This includes e-wallets such as PayPal and Skrill, bank or wire transfer and credit/debit cards like MasterCard and Visa. It is advised that the user choose the same payment method as was used for the initial deposit. So if you made your initial deposit using a debit card, it is advisable you use the same for withdrawals.

Plus500 Withdrawal Processing Time

The average time for processing a withdrawal request at Plus500 is one to three business days. This is largely due to the myriad of security checks that need to be conducted before sending the payment. Plus500 checks the user’s identity, verifies it and makes sure that the money has no possibilities of being sent to the wrong person. The broker complies as a regulated broker with all existing industry security checks to protect against frauds and scams. This makes the account verification step the most important.

The money will be sent to the trader after the request is processed and confirmed by the Plus500 team. The time taken to get the withdrawal money sent to your account depends on the withdrawal method selected. E-wallets are generally the fastest payment method.

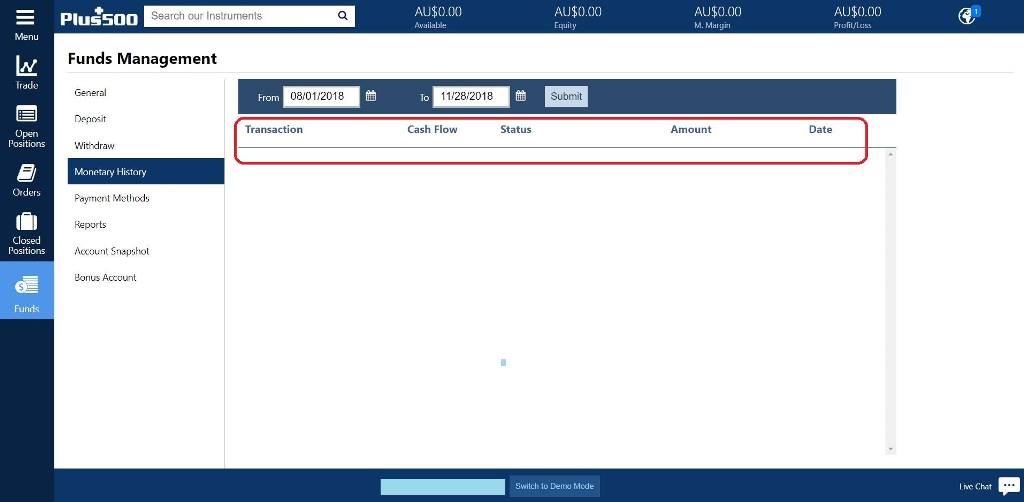

During the whole withdrawal time period, the withdrawal request goes through certain stages. You can check the status of your request under Funds Management> Monetary History. The stages are mentioned below.

- Requested: This is the first stage of the withdrawal request that shows that the payment is yet to be processed. You can cancel your withdrawal request at this point if you have a change of plans. Do this by going to Fund Management> Monetary History> Cancel Withdrawal.

- Approved: This stage means that your withdrawal request has been authorised by the broker and is in progress. However, the funds are not sent to the appropriate external payment processing party at this stage.

- Approved Sent: At this stage, the trader’s funds are sent to the relevant third party processing party.

- Approved Settled: This is the last stage of the entire process from the Plus500’s end. However, funds could still face delays entering the user’s account due to issues with the processing party.

You can cancel the withdrawal request while the withdrawal request is in the “Approved in Progress” status. On the other hand, Plus500 can cancel the withdrawal request at any stage if you have liabilities for any transactions completed during the withdrawal request.

Plus500 Withdrawal Fees

One of the main reasons why Plus500 is popular among traders is its fee structure. They charge very competitive fees and offer zero commissions. They offer a number of free withdrawals for their clients, something which is seldom done by other brokers. Plus500 keeps the right to charge for exceeding the maximum number of monthly withdrawals. Traders could find more information in the User Agreement.

Minimum Withdrawal Amount

Plus500 has set the minimum deposit amount at $100. However, the minimum amount one can withdraw depends on the payment method he or she selected. For example, it is $100 if you use Bank transfers or a Visa debit/credit card and $50 for PayPal or Skrill users. It’s always advised to deposit some extra money in your trading account to ensure that the withdrawal request can be completed. Plus500 will pay you the full amount paid to you once you meet the minimum balance required.

Withdrawal limitations

There are some limitations to the withdrawal method of Plus500 which can you can easily overcome if you follow and study the rules carefully.

- Verification of documents: The verification of documents is something that affects some trader’s withdrawal requests and processing, especially if you don’t have your account verified. For the verification procedure, a user has to upload two important documents showing proof of address and proof of identity. As proof of address, one can submit a utility bill or bank statement, while a passport or driving license may be used as proof of identity. Plus500 may also request the user to send a scan of the front of the user’s credit card or bank statement to prove they are the rightful person to receive the withdrawal.

- Withdrawal amount limitations: A user cannot withdraw the full amount in their account if they have open trades left. They can check the overview of their account balance from the top panel of the Plus500 interface. Plus500 can only pay out the available part of the trader’s account balance. Every trader has to comply with a maintenance margin when they open a position. It refers to the minimum amount they need in their account to keep a position open.

- Leaving money in trader’s account: Plus500 does not recommend its users to keep their funds in their trading account when they aren’t regularly trading. They may be liable to pay an inactivity fee to the broker if they do not use the account for a long time. Plus500 charges an inactivity fee for customers who have not logged into their account for more than three months. The fee is levied at $10 per quarter after the initial three month period is passed. But unlike the majority of other brokers, Plus500 doesn’t charge this fee for not trading, but for not logging in. This means you won’t be charged the inactivity fee if you login frequently and do not execute trades.

Final Word

Plus500 combines security with a utilitarian interface that showcases different trading capabilities. It can be considered as one of the most popular CFD-only brokers operating on the market. Clients get an impressive CFD collection spanning across different asset classes. It also caters to different traders via the account options it provides and by providing support in 12 different languages. Being regulated by three of the top regulatory bodies in the world, we can definitely recommend trading CFDs with this platform.

For more please read Plus500 Broker Review

Note: CFD Service. Your capital is at risk

FAQ

Plus500 covers most of their user’s payment fees. However, a user may incur fees when transferring money to and from their trading account. These are actually levied by the respective bank or payment issuer and not by the broker. You may incur some fees for the following actions:

- Fees can be charged for FX conversions where the user deposits a currency not supported by their preferred payment method.

- Fees can be incurred when transferring money to Plus500 from your bank account and vice versa.

- Fees are applicable on transactions via International credit cards.

Plus500’s withdrawal method is designed to be as user-friendly and easy as possible. The whole process can take anywhere from one to three business days. Additional time may be required depending on your bank or payment processor. You can always contact their customer support staff for queries related to withdrawals. Plus500 provides support via a live chat customer service as well as email and operates on a 24/7 basis.