How does Forex Trading Work?

In countries like South Africa, trading Forex is a very popular practice as there are many online brokerage platforms available that are regulated by the FSB (Financial Services Board) and offers assistance for this type of trading. Therefore, if you are a citizen of this country and want to get yourself involved in this kind of trading, you would need to have extensive knowledge about multifarious aspects foreign exchange trading.

In countries like South Africa, trading Forex is a very popular practice as there are many online brokerage platforms available that are regulated by the FSB (Financial Services Board) and offers assistance for this type of trading. Therefore, if you are a citizen of this country and want to get yourself involved in this kind of trading, you would need to have extensive knowledge about multifarious aspects foreign exchange trading.

Foreign Exchange Market

Introduction

The word Forex came as an abbreviated form of the term Foreign Exchange. The foreign exchange market basically refers to a decentralised (also known as Over-the-Counter or OTC) market for trading various currencies. Forex trading is an all-encompassing term that includes buying, selling, and exchanging of currencies at a predetermined or current price. Till date, the Forex market is the largest market in the world in terms of trading volume (5.09 Trillion USD per day in April 2016).

Although the main participants of this trading are renowned international banks or other financial organisations, individuals can also participate in this trading process and secure a considerable amount of profit. One of the most important aspects of this trading is that the values of certain currencies cannot be measured absolutely because they are always traded in pairs.

In countries like South Africa, trading Forex is a very popular practice as there are many online brokerage platforms available that are regulated by the FSB (Financial Services Board) and offers assistance for this type of trading. Therefore, if you are a citizen of this country and want to get yourself involved in this kind of trading, you would need to have extensive knowledge about multifarious aspects foreign exchange trading. Here, some of those aspects would be discussed for your convenience.

Important Terms Related to Forex Trading

ForexQuotes:Forex quotes are always made up of different currency pairs. One of those two currencies is the base currency and the other one is the quote before you involve yourself in this type of trading, knowing certain terms and their corresponding definitions are of utmost importance. Otherwise, you might find yourself at a loss when certain jargons are used during a live trading. Some of these terms are:

Forex Quote: Base currency refers to the currency you are buying and the quote currency refers to the currency you are selling in exchange. The relative value of each currency changes according to itsForex quote. It is one of the most basic pieces of knowledge that a trader should have before delving into this market

Forex Quote of Euro and USD

Bid Price and Ask Price: The bid price of a certain currency pair refers to the maximum price that the buyer intends to pay for the currency s/he is buying. On the other hand, the ask price refers to the minimum price a seller is willing to accept. The condition of a specific trading changes drastically depending on the changes on bid and ask price.

Quoted Spread: The quoted spread or simply spread can be defined as the difference between the bid price and the ask price. The spread provides an accurate measurement of the service remuneration offered by the dealer to the traders. The value of this remuneration changes commensurately with the change in spread. Spread determines a lot of important factors in Forex trading, including the possible amount of profit and loss after a trading is completed.

PIP: PIP is one of the most important terms that a trader should learn thoroughly in order to become a successful foreign exchange trader. PIP is the acronym for percentage point which refers to the smallest possible movement or change in the value between two currencies. Except for Japanese Yen, all currencies are valued up to 4 decimal places. Therefore, if the value of the currency pair USD/ZAR moves by 0.0002, it would be tantamount to 2 PIPs. Similarly, for EUR/JPY trading pair, a change of 0.01 would refer to 1 PIP for the currency pair.

Lot: A standard lot is equivalent to 100,000 units of a particular currency. However, a trader can trade in mini or micro lots as per the condition of a particular trading. A mini lot is equivalent to 10,000 currency units whereas a micro lot is equivalent to 1,000 currency units.

Useful Trading Strategies

After being au fait with the basic terms associated with this trading, you have to become well-versed with the available trading strategies and their applications. Forex trading strategies can be broadly classified into day or intraday trading and swing trading. The day trading always gets finished within a specific day whereas, in case of swing trading, the trader has to wait patiently for the right moment to buy and sell. Below, you will find some of the very popular strategies used in Forex trading:

- The Bladerunner Strategy: This trading strategy can accurately find out breakout points form a continuation and trade the resets. Bladerunner strategy can be used in all timeframes and for all available currency pairs.

Bladerunner Strategy Chart

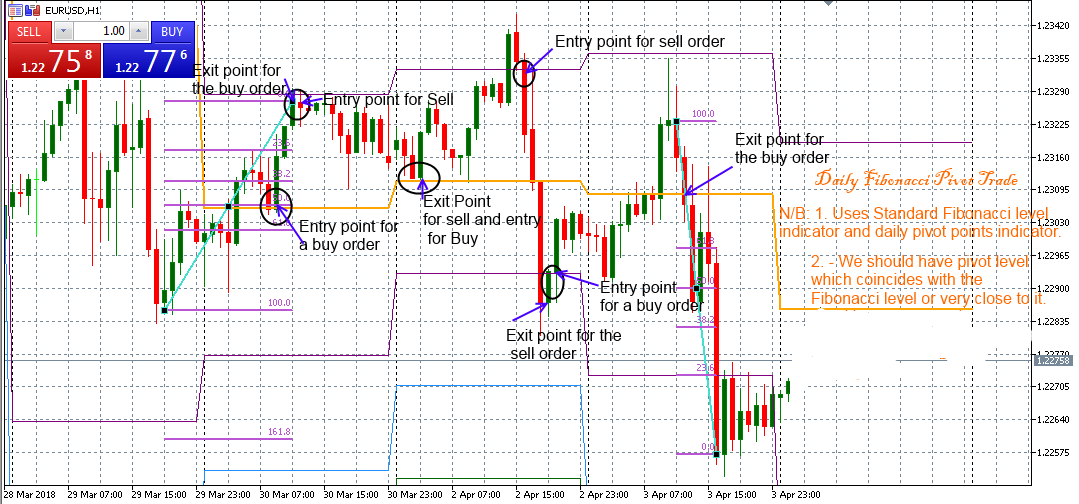

- Daily Fibonacci Pivot Trade: This is a daily trading strategy that is based on the algorithm of Fibonacci sequence. This strategy successfully combines Fibonacci extensions with daily, weekly, monthly, and yearly pivots. It is one of the most useful daily trading strategies that investors use all around the world.

Chart for Fibonacci Pivot Trading Strategy

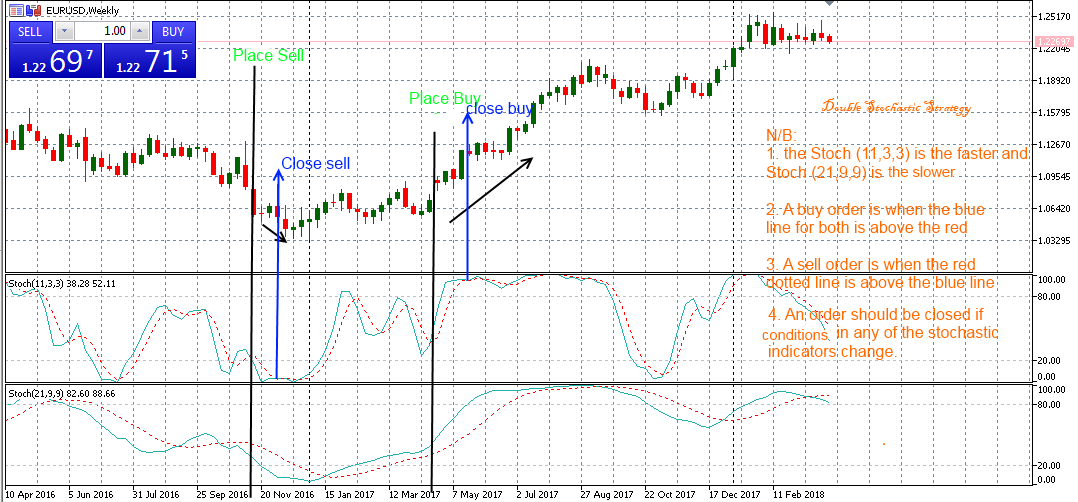

- Dual Stochastic Trading Strategy:This trading strategy is based on the combination of both fast and slow stochastic trading strategies to figure out the areas where price is trending at the moment and about to form a continuation of the current trend.

Dual Stochastic Strategy Chart

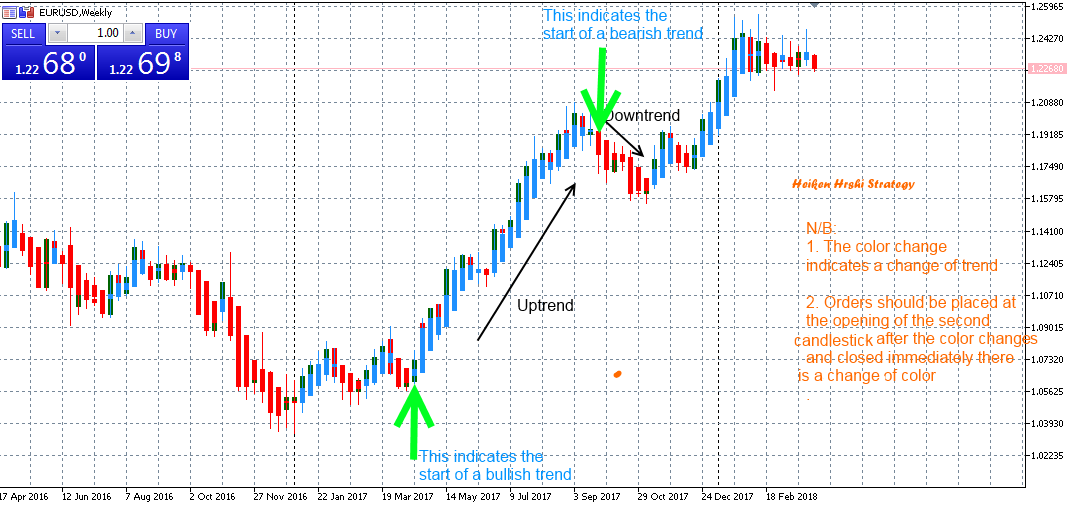

- Heikin-Ashi Strategy: It is one of the most ingenious strategies that modern Forex traders use. It is based on the Heikin-Ashi chart that is a special form of candlestick chart with different plotting methods.

Chart for Heikin-Ashi Strategy

Factors to Consider before Being Involved in Forex Trading

Once you garner sufficient knowledge about this type of trading, you can start a Forex trading on your own. But as the volatility of this market is well-known, there are some points that novice traders should consider:

Choosing a Suitable Brokerage Website: Nowadays, there are myriads of online brokerage websites that assist the investors in their trading. As a neophyte, it is of the utmost importance to choose the right website. During this selection, the investor must examine factors like regulation, available trading platform and currencies. For example, all legitimate South African brokerage websites are regulated by the FSB. Also, the brokerage website should offer a demo account for the traders to get used to this business.

Implementation of Strategies and Understanding Signals: For proper application of the previously learned strategy, you can use the trading tutorials offered in various trading platforms. Also, accurate interpretations of the trading signals can be extremely effective during a live trading.

Being Aware of the Risks: It is very important to have some idea about the pitfalls of Forex trading because everywhere there is a chance to secure some lucre, there is also a certain amount of risk involved. A considerable number of traders end up losing a lot of money by investing too much right in the beginning. Therefore, for a neophyte, it is preferable to take things slow at the beginning and invest an amount that can be afforded if the trading goes wrong in the future.

Available Mediums

Forex trading can be conducted successfully by regular operating systems available in desktops and laptops. Nowadays, even Smartphone holders can conduct such trading by using various innovative mobile trading apps.

Final Thoughts

The domain of Forex trading is expanding rapidly with the introduction of new trading entities such as cryptocurrencies. In this constantly expanding market, being successful requires a considerable amount of patience, skill, and knowledge. South Africa is one of the leading countries in trading Forex and cryptocurrency. By choosing the right trading platform and taking the vagaries of this market into account, even a novice investor can become a successful Forex trader.