Spectre.ai Review 2023 - The Revolution in Binary Options Trading

What is Spectre?

Spectre (speculative tokenized trading exchange) is a decentralised, brokerless trading platform built on the Ethereum blockchain. Spectre offers Smart Options (similar to binary options) on currency pairs, commodities, and certain cryptocurrency/fiat currency pairs.

With its clever utilisation of the Ethereum blockchain and smart contracts, Spectre has revolutionized online trading. All the trades performed on Spectre’s trading platform are securely governed and processed by a set of audited smart contracts. Every single trade entry, outcome, and payout is regulated by this governing set of smart contracts, creating unheard of execution transparency you can trust. With Spectre, there is no exposure to fraudulent conduct of shady brokers, just straight-forward trading.

Spectre’s balance sheet (liquidity pool) is owned by Spectre token holders and not by a centralised management. These token holders receive dividends based on Spectre’s trading volume.

Overview:

- Minimum deal size of only $1

- Get started with less than $25 (0.10 ether)

- Free demo account available!

- Built-in economic calendar

- Min. expiry time: 10 seconds

- Max. payout percentage of up to 83%

- 24/7 support

Note: Your capital is at risk

Regulation - Who Can Trade on Spectre’s Platform?

Spectre’s services and Smart Option contracts are available to most individuals around the globe, even to traders from the European Union. This might surprise many people because ESMA (the European Securities and Markets Authority) has recently enforced strict regulations on EU traders to withhold binary options and certain other types of options from most of them. Spectre, however, is not affected by ESMA regulations and can, therefore, offer Smart Options to their EU clients.

There are some countries who cannot make use of Spectre’s services at the moment - Costa Rica, USA, British Virgin Islands, Cayman Islands, Iran, Venezuela, United Kingdom, Syria, Somalia, North Korea, and Yemen. Spectre.ai is currently licenced with COSTA MEDIA INTERACTIVE SRL in Costa Rica and has other jurisdictional licenses under application in order to obtain access to as many territories as possible.

Spectre’s services and products are not available to persons under the age of 18 years.

Spectre’s Range of Tradable Assets

Spectre offers a good range of Smart Options on forex pairs, cryptocurrency/fiat currency pairs, and some commodities. Here is a screenshot of the instruments which are currently available on Spectre’s demo, Regular, and Wallet trading accounts (excluding the 20 additional instruments which are available on Regular and Wallet accounts through SXUT privileges):

YOU CAN CHOOSE BETWEEN 30 SMART OPTION INSTRUMENTS!

These 30 instruments are made up of:

18 forex pairs:

- AUD/JPY (Australian dollar/Japanese yen)

- AUD/NZD (Australian dollar/New Zealand dollar)

- AUD/USD (Australian dollar/United States dollar)

- CAD/JPY (Canadian dollar/Japanese yen)

- EUR/AUD (euro/Australian dollar)

- EUR/CHF (euro/Swiss franc)

- EUR/GBP (euro/Great British Pound)

- EUR/JPY (euro/Japanese yen)

- EUR/USD (euro/United States dollar)

- GBP/AUD (Great British Pound/Australian dollar)

- GBP/CHF (Great British Pound/Swiss franc)

- GBP/JPY (Great British Pound/Japanese yen)

- GBP/USD (Great British Pound/United States dollar)

- NZD/JPY (New Zealand dollar/Japanese yen)

- NZD/USD (New Zealand dollar/United States dollar)

- USD/CAD (United States dollar/Canadian dollar)

- USD/CHF (United States dollar/Swiss franc)

- USD/JPY (United States dollar/Japanese yen)

10 cryptocurrency/fiat currency pairs:

- BCH/USD (bitcoin cash/United States dollar)

- DASH/USD (dash/United States dollar)

- ETH/EUR (ether/euro)

- ETH/USD (ether/United States dollar)

- LTC/USD (litecoin/United States dollar)

- XBT/EUR (bitcoin/euro)

- XBT/GBP (bitcoin/Great British Pound)

- XBT/USD (bitcoin/United States dollar)

- XMR/USD (monero/United States dollar)

- XRP/USD (ripple/United States dollar)

2 commodities:

- XAG/USD (silver)

- XAU/USD (gold)

Smart Option Expiry Times

Spectre’s Smart Options can be traded with a wide range of standard expiry times from 10 seconds up to the end of the current day. These are the standard expiry times:

- 10 sec

- 30 sec

- 60 sec

- 5 min

- 10 min

- 15 min

- 20 min

- 25 min

- 30 min

- 35 min

- 40 min

- 45 min

- 50 min

- 55 min

- 60 min

- end of the current day

Traders also have the option to select custom expiry times (available in 5-minute increments which may extend a few days into the future). Custom expiry times cannot extend beyond weekends and trading holidays, however. Traders may use this feature to trade a Smart Option contract with an expiry time of 2 hours and 35 minutes, for example.

Trade Payout Percentages (Profitability Percentages)

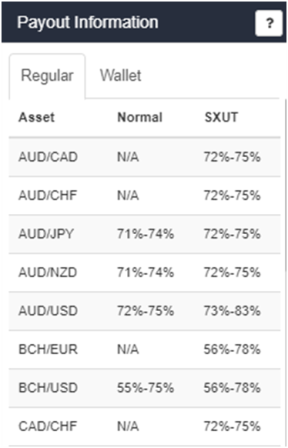

The trade payout percentages on Smart Options differ, depending on the instrument which is traded, the expiry time, the Spectre account type, the time of the day, and whether the SXUT privileges that apply to increased payouts have been unlocked. Regular account holders enjoy higher payout percentages than traders with Wallet accounts.

The range of payout percentages are always displayed on the left side of the trading platform. Here is an example of the payout percentages for a Regular trading account (with and without SXUT privileges) on a normal trading day at about 14:00 GMT:

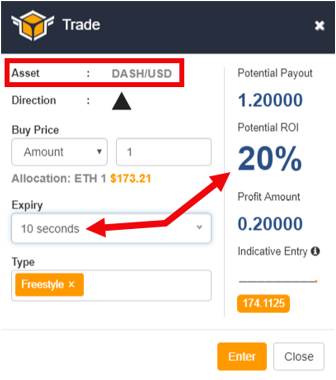

With Smart Option instruments that have wide spreads like some cryptocurrency/fiat currency pairs, the payout percentages on an individual instrument can vary considerably between different expiry times. For example, the DASH/USD pair could have a payout of 20% if traded with a 10-second expiry, while the “End of Day” contract could have a payout percentage of 60%.

A DASH/USD SMART OPTION CONTRACT WITH A 10-SECOND EXPIRY AND PAYOUT PERCENTAGE OF 20%.

A DASH/USD SMART OPTION CONTRACT WITH AN “END OF DAY” EXPIRY AND PAYOUT PERCENTAGE OF 60%.

Other Smart Option instruments with tighter spreads (like currency pairs and commodities) can have much more uniform payouts across different expiry times. However, the indicative entry prices (IEP) on these instruments differ from the spot price (which is displayed on the chart) with the micro expiries of 10 seconds and 30 seconds. This may also be the case with some of the higher expiries in times of low market liquidity. In cases where the IEP is not equal to the spot price, the trader pays the bid-ask spread and achieves a strike price (entry price) which is not as good as the spot price .

*Please note that Spectre’s payout percentages can change at any time.

What is SXUT?

SXUT is a utility token that functions with the Ethereum blockchain's smart contracts. It can be bought for a certain dollar amount per token (which may fluctuate often) and stored in an ERC-20 wallet/account.

*ERC-20 is a technical term for smart contracts that are used on the Ethereum blockchain to establish tokens.

What are SXUT Privileges and How is it Obtained?

To enjoy certain privileges (like higher trade payouts) on Spectre’s trading platform, you need to have a certain amount of SXUT utility tokens in your ERC-20 account. Spectre pings your ERC-20 account to see if you have enough SXUT tokens in it to unlock/keep a certain privilege unlocked. The tokens need not be spent, they just need to be in your ERC-20 account.

Advanced Risk Management Features

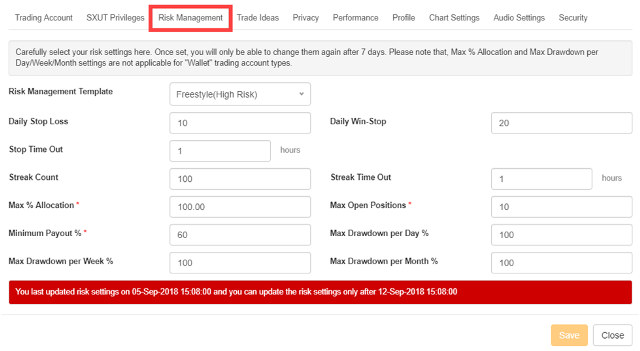

The designers of the Spectre trading platform have taken great measures to reduce the risks associated with trading. Here is Spectre’s remarkable risk management tool which can be accessed via the “Account Settings” option by clicking the settings(gear) icon at the top right of the trading platform:

This risk management tool can be adjusted by traders to suit their individual trading styles and level of risk appetite. After a trader saves his preferred risk parameters, he can only make changes to it again after 7 days. This “safety belt” feature helps to prevent traders from making impulsive changes to their risk settings that may not have been thought through properly.

Spectre’s risk management tool can be used to place limits on many different parameters which include the following:

- Daily Stop Loss

- Daily Win-Stop

- Stop Time Out

- Streak Count

- Streak Time Out

- Max % Allocation

- Max Open Positions

- Minimum Payout %

- Max Drawdown per Day %

- Max Drawdown per Week %

- Max Drawdown per Month %

Here is an example of the “Daily Win-Stop” function which enables traders to set a limit on the number of winning trades made on any particular day:

This is an interesting feature which stops traders from placing additional trades after a certain number of winning trades have been achieved on a particular day. When the specified number of winning trades is reached, the trader cannot place additional trades for a certain number of hours (this number is also specified by the trader).

All these adjustable risk management parameters provide traders with much more control over the risks related to trading. Many of the common pitfalls like overleveraging, overtrading, and emotional trading can be greatly reduced by these pre-set safety mechanisms.

With Spectre’s risk management tool, traders can choose between four different risk templates:

Each of these templates come with standard settings which can be used just as they are or customised by the trader and saved.

Explore the Markets With a Free Demo Account

A demo trading account is often a handy tool for practising or strategy testing. Spectre’s demo account is well-equipped with most of the features and instruments of a real money account.

Three Live Account Types (Real Money Trading Accounts)

Traders who need live accounts can choose between a regular account and a wallet account. Here are the differences/requirements in a nutshell:

Regular Trading Account:

Traders need to deposit ether (Ethereum) into a cryptographically secured smart contract wallet at Spectre from which they can execute trades on Spectre’s platform. The other way to deposit and trade with a Regular account is via Uphold. With Uphold, traders can deposit fiat currency and receive ether (Ethereum) into their Uphold accounts from which they can connect and trade on Spectre’s platform. As mentioned earlier, Spectre’s Regular account offers higher trade payouts than the Wallet account. With a Regular trading account, there are small deposit and withdrawal fees that reflect gas fees for Ethereum. Withdrawal times are as follows:

- For accounts funded from offsite Ethereum wallets - 24 hours for trading profits. Existing deposits can be withdrawn immediately.

- Accounts funded with Uphold - trading profits and deposits can be withdrawn instantly.

Wallet Account:

This is the fully decentralised, brokerless trading option. Here you never deposit and all trades are initiated by you through your cryptocurrency wallet using the Spectre trading platform. You pay gas cost for every trade and the payouts when trading from a Wallet account are usually less than that of a Regular account.

Decentralised Wallet Account

This is a new feature that has been added to Spectre.ai. This serves as an alternative to trading the traditional way. Users never have to deposit in order to trade, ensuring compete transparency and safety of user’s funds. The DeFi boost allow users to trade and deposit using their top DeFi coins. They can earn between 70 % and 400 % within a few seconds to a few hours. This however depends on how the users construct their digital contract. Currently the list of supported DeFi coins include USDC, SNX, LIN, AAVE, PAX, BAND, KNC, LEND and Spectre’s native platform tokens, SXUT and SXDT.

Minimum Deposit

The minimum deposit for a Regular account is 0.10 ether (Ethereum), which is about $21.00 or 18.00 euro. Of course, the amount in fiat currency varies all the time, according to the ether/fiat exchange rate.

Wallet account holders don’t make deposits because their trades are done directly from their personal cryptocurrency wallets.

Minimum Trade Size

The minimum deal/trade size for Regular account holders is $1. For Wallet account holders it is $50.

Maximum Amount Per Trade

For Smart Options, the maximum amount per trade is:

- $1,000 in 2018

- $3000 in 2019

- $10,000 in 2020 and onward

Other Platform Features

Charting and Technical Indicators

Spectre has a variety of technical indicators to choose from, including Ichimoku, Bollinger Bands, moving averages, Awesome Oscillator, RSI, CCI, stochastics, etc. The technical indicators can be found under the “Studies” tab at the top of the chart window:

Different graphical tools can be accessed via the “Select Tool” tab:

Trade Ideas

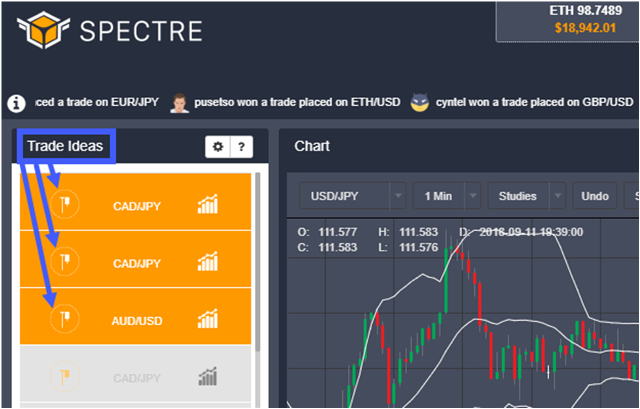

Spectre has different smart algorithms that pick up certain technical price patterns which may result in high probability trade setups. These trade idea indicators can be activated/deactivated by traders according to their personal preferences. When a certain trade idea is active, it will alert traders (on the platform) when it is triggered. Here is an example of trade idea indicators that have been triggered and are still “fresh” and tradable:

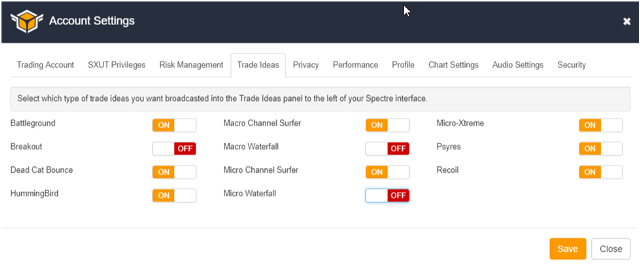

Traders can click on each trade idea on the platform for details on how to use it as well as a video tutorial. There are 11 of these trade idea indicators available at the moment. They can be activated in the “Account Settings” window:

Built-in Economic Calendar

Economic events have the potential to impact the financial markets severely. It is, therefore, important for many traders to keep a close eye on an economic calendar. Spectre’s trading platform is equipped with a built-in economic calendar which can be opened by simply clicking on the tab on the right side of the trading platform:

Conclusion

Spectre is geared towards efficiency, reliability, transparency, and accountability with its Ethereum blockchain-based trading platform. Although Spectre uses blockchain and smart contract technology, its trading platform is easy and convenient to use. Spectre has had a good kick-off with its Smart Options and will add other financial instruments to its offering soon. This includes CFDs on commodities, stocks, and cryptocurrencies. Forex pairs (common forex trading) will also be available soon with super-tight spreads. There won’t be leverage available on these instruments, however.

The features found on Spectre’s trading platform are really great, especially the risk management system and trade idea indicators.

Spectre’s Wallet account is a really uncommon but excellent feature, as traders can trade Smart Options without having to deposit money to a broker.

The individuals who choose Spectre’s Regular trading account and who need to convert fiat currency to ether, can do this with minimal effort with the help of Uphold. Whether you’re funding your trading account with ether or with fiat currency, Spectre makes it convenient for you.

Lastly, Spectre is evolving rapidly and clients will soon be able to trade the additional instruments mentioned above on their MT4 platforms. An API will also be available soon, which means that algorithmic traders will be able to run their trading robots and other applications on Spectre’s platform.

Note: Your capital is at risk