Spread and Other Forex Trading Costs

Millions of traders and investors participate in the Forex trading market daily. Day by day the number of Forex broker websites even as they compete with each other to provide tighter spreads and advertise that with them the traders will make most profits. Compared to the stock market and other such markets, the Forex market offers greater leverage and is more volatile thus, making it riskier and more interesting for the investors and traders to play the market.

Millions of traders and investors participate in the Forex trading market daily. Day by day the number of Forex broker websites even as they compete with each other to provide tighter spreads and advertise that with them the traders will make most profits. Compared to the stock market and other such markets, the Forex market offers greater leverage and is more volatile thus, making it riskier and more interesting for the investors and traders to play the market.But, if all the gains are made by the traders as many brokers advertise then, where from do the brokers earn money. Of course, they are not doing any charity. Spread is one area where the brokers benefit from. The income for the brokers also comes from commissions, leverage and overnight positions.

A Short Note on Bid and Ask

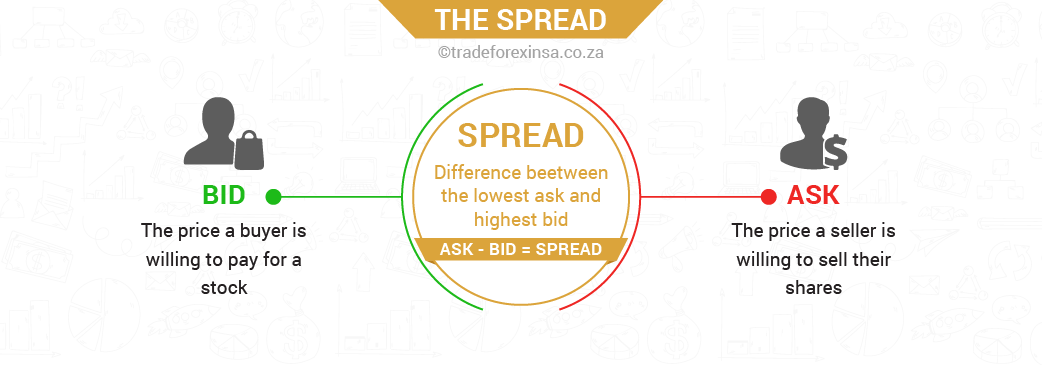

When trading on the forex market the investor has to choose a currency pair, for instance, EUR/USD. Here, EUR is the base currency and USD is the quote currency. When an investor purchases a quote currency it is called Bid. The amount at which the quote currency is sold by the investor is called Ask.

Spread

Spread is basically the difference between the ask and bid price. Spread is usually represented in pips (percentage in point). It replaces the transactions fees and is the new way of taking service costs. The cost varies from one forex broker to another. The trader will make a profit only when the price of the currency pair (or asset) will move high enough to cover the cost of the spread. In Forex trading the following types of spreads are usually observed.

Fixed spread: The difference between the bid and the ask price is not dependent on the market situations and is thus kept constant. Fixed spreads are usually meant for automatically traded accounts.

Fixed spread with an extension: A section of the spread is predetermined while the dealer may choose to adjust the other part according to the market condition.

Variable spread: The variable spread is irretrievably dependent on the market situation. When the market is ‘inactive’ the variable spread is generally low (approx. 1-2 pips). True variability is seen in a volatile market when the spread value may be as high as 40 to 50 pips. It is closer to the real market. In such a situation the trade has to be more careful when devising a trading strategy as the market may or may not be in their favour.

The beginner should learn to determine the extremes of the spread from the variable spread graph. When the spread ranges from 0 to 1 pip, the trader should simultaneously open Buy and Sell positions and close these positions at maximum spread. Then, the profit will be equivalent to the maximal spread value. The trading strategy in such a situation faces ‘little’ risks as the profit probability depends on the spread value rather than actual currency pair quotation. The chances of earning more prits as the experts say is when the trading position during minimal spread.

The Spread

Factors influencing spread in Forex trading

Currency liquidity is the major factor that influences the distance between the bid and ask offers. Popular currency pairs like the one having USD usually sport lowest spreads. But, if the trader chooses a currency pair like one where Singaporean dollar is the base currency then it may raise larger pips spread.

- Currency liquidity is the major factor that influences the distance between the bid and ask offers. Popular currency pairs like the one having USD usually sport lowest spreads. But, if the trader chooses a currency pair like one where Singaporean dollar is the base currency then it may raise larger pips spread.

- The second factor is the amount of a deal. Moderate sized deals that are executed on quotations have standard tight spreads while extremes generally are quoted with broader spreads. This because of the risks involved in extreme deals (too small and too big).

- A fickle market bid-offer spreads are usually wider than the quieter ones.

- The status of the customer also influences the pips value to a certain extent as the large-scale traders/investors enjoy personal discounts on premium clients. The brokers in this market of competition are trying to stay close to their customers by providing tighter spreads.

As seen, the spreads are always subject to change and thus the trader should always pay close attention to the spread management. The trader can gain more profits only if he takes the market conditions into account. For this, the trader will have to consult the trading analysis tools, trading charts and market indicators. The spread management strategy should be elastic enough to accommodate different market movements.

Commission in Forex trading

Some of the brokers of Forex trading continue to charge commissions that can either be a fixed sum or a relative fee. It is quite similar to the spread and is charged on every trade. Fixed fee means that the broker will charge the same amount irrespective of the size and volume of the trade placed. Relative fee has to be calculated and may be based on the volume of the trade placed. It is usually directly proportional to the trading volume.

Leverage

Leverage is the method by which traders can increase the returns on their initial investment. Many brokers offer easy access to the leverage tool to their clients. However, the trader has to be careful in using the tool as this can inflate the cost of each trade to insurmountable levels.

Overnight positions

The brokers also levy a charge when trades are held overnight by a trader. The cost is mainly focused on the forex market and is popularly called the overnight rollover. Every currency a trader purchases or sells has an overnight interest rate attached to it. The overnight charge can be calculated from the difference between the interest rates of the two currencies of a currency pair. The brokers do not have a hand in it rather the Interbank level decides it.

Additional fees

In some brokerage websites there are some additional charges that are often cleverly hidden. The traders are often advised to avoid brokers that do not clearly show these charges. The charges usually include account inactivity fees, monthly or quarterly charges and margin costs. If a trader is used to trading at high volumes then he may prefer to pay a fixed amount in keep the costs low. But, traders who trade comparatively low volumes may prefer a charge based on their trade size.