FP Markets Review 2025 for South Africa - Scam or Legit?

Founded in 2005, FP Markets is an Australian broker that allows trades to CFD trading across forex, commodities, stocks, indices, and cryptocurrencies in best trading conditions on consistently tighter spreads. The broker is universally trusted as a Forex and CFD broker where traders have access to a full suite of trading products and they can trade from a single account conveniently. It is regulated by the Financial Sector Conduct Authority in South Africa (FSP Number 50926), Cyprus Securities and Exchange Commission (CySEC), Australian Securities and Investments Commission (ASIC), and the Financial Services Authority of St. Vincent and the Grenadines.

Founded in 2005, FP Markets is an Australian broker that allows trades to CFD trading across forex, commodities, stocks, indices, and cryptocurrencies in best trading conditions on consistently tighter spreads. The broker is universally trusted as a Forex and CFD broker where traders have access to a full suite of trading products and they can trade from a single account conveniently. It is regulated by the Financial Sector Conduct Authority in South Africa (FSP Number 50926), Cyprus Securities and Exchange Commission (CySEC), Australian Securities and Investments Commission (ASIC), and the Financial Services Authority of St. Vincent and the Grenadines.

Overview:

- Minimum Deposit: 100

- Maximum Leverage: 500:1

- Tradeable Assets: Forex, Shares CFDs, Metals, Commodities, Indices, Cryptocurrencies

- Regulated By: FSP, CySEC, ASIC, and FSA

- Demo Account: Yes

Note: Your capital is at risk

The broker is considered safe by clients because of its long track record and regulation under top-tier authoritative bodies. Moreover, the clients’ funds are held in separated client accounts from the company’s own fund which gives more security to clients’ money. FP Markets was awarded by the ‘Investment Trends CFD Report’ for five years running for the most traders.

Other awards received by the broker were for best trade execution, best value for money, and best customer service.

FP Markets Pros and Cons

| Pros | Cons |

| Forex fees are low | Stock CFD fees are high |

| You can open accounts fast and easy | Product portfolio is limited |

| Traders can execute deposit and withdrawal processes quickly | |

| The services of the broker comply with the strictest regulation for investors’ protection. | |

| The broker offers consistently tighter spreads from 0.0 pips. | |

| FP Markets does not have price manipulation, dealing desk, or re-quotes. | |

| The broker offers multi-lingual customer support 24/5. | |

| Authorised and regulated in South Africa by FSP |

FP Markets Account Types

FP Markets has two types of trading accounts, such as –

- Standard Account: The broker charges zero commissions with a standard account on MT4 or MT5 platform as any fee is built into the spread.

- Raw Account: With the popular Raw account of FP Markets, traders can trade forex and other trading assets with spreads starting from as low as 0.0 pips. It is possible since the broker has access to a large pool of top-tier liquidity providers. Hence, clients are provided with institutional-grade liquidity with no requotes and no price manipulation.

Forex account types

| Account | Standard MT4-MT5 | Raw MT4-MT5 |

| Spreads | From 1.0 pips | From 0.0 pips |

| Instruments | 50+ FX pairs, metals, indices, commodities | 50+ FX pairs, metals, indices, commodities |

| Execution | ECN-Pricing | ECN-Pricing |

| Commission per Lot | Zero | $3.0 |

| Minimum Deposit | 100 AUD or equivalent | 100 AUD or equivalent |

| Maximum Leverage | 500:1 | 500:1 |

| Minimum Trade Size | 0.01 Lot | 0.01 Lot |

| EA's | Yes | Yes |

| Mobile App | Yes | Yes |

| VPS Available | Yes | Yes |

IRESS account types

| Account | Standard IRESS | Platinum IRESS | Premier IRESS |

| Commission (ASX) | 10 AUD min, then 0.1% | 9 AUD min, then 0.09% | No min, then 0.8% |

| Minimum Deposit | 1,000 AUD | 25,000 AUD | 50,000 AUD |

| Equity CFD margin rates | From 3% | From 3% | From 3% |

| Financing | FP Markets Base Rate +4.0% | FP Markets Base Rate +3.5% | FP Markets Base Rate +3.0% |

FP Markets Islamic Accounts

Islamic accounts are also known as swap-free accounts. These accounts are ideal for Muslim clients as they do not incur swaps or interest charges on overnight positions, which is in line with Islamic law. Instead, the broker charges the account holder an administration fee on positions. This fee is deducted from the account balance.

Trading in Islam can be considered haram but you can still trade with an Islamic forex account that offers swap-free trading and is designed for forex traders unable to pay or receive swap or rollover interest on overnight positions because of their religious beliefs according to the Sharia Law.

To open an Islamic forex account on FP Markets, you need to open a MetaTrader 4 or MetaTrader 5 account first. After that, you can request to convert it into an Islamic account. FP Markets does not offer swap free accounts on IRESS, they are only provided on MetaTrader platforms.

To make sure that your trading activities are halal, you may consult a religious authority that take your personal situation into account. Islamic accounts offered by FP Markets are

| Account MT4-MT5 | Islamic Standard | Islamic Raw |

| Minimum Opening Balance | 100 AUD or equivalent | 100 AUD or equivalent |

| Spreads | From 1.0 pips | From 0.0 pips |

| Instruments | 60+ FX pairs, metals, indices, commodities | 60+ FX pairs, metals, indices, commodities |

| Maximum Leverage | 500:1 | 500:1 |

| Execution | ECN - Pricing | ECN - Pricing |

| Commission per Lot | Zero | $3 per 100,000 |

| Minimum Trade Size | 0.01 Lot | 0.01 Lot |

| EA's | Yes | Yes |

| Mobile App | Yes | Yes |

| VPS Available | Yes | Yes |

Demo Account

FP Markets offers the benefit of a demo account for those traders who want to master their skills and become familiar with the trading platforms better before opening a live account and put their money into risk.

By opening a demo account on FP Markets, you can:

- Learn about asset classes and complex instruments, and use trading tools without funding your account with a minimum deposit.

- Follow the step-by-step tutorials of FP Markets on how to trade with the MetaTrader 4 and MetaTrader 5 trading platforms.

- Watch webinars that can help you to learn about forex trading. It includes recognizing high risk indicators and understanding the impact of interest rates on forex.

- Harness an understanding of base currency and other types to take the next step and follow forex experts’ technical analysis.

Note: Your capital is at risk

How to Open Account on FP Markets

Opening an account of FP Markets is easy and simple, and you can do it online. If you are a beginner and want to get better at trading without risking money, then you can practice trading on the FP Markets demo account with 50,000 in virtual money. If you want to get into real-time trading, then open a live account within minutes and start trading. Follow these steps to open an account on FP Markets

- Visit the official website of FP Markets and click on the big blue button on the homepage that says “Start Trading”. You will be redirected to the page with the trading application form.

- Sign in with Google or Facebook. Then, fill in personal information like Email, name, country, account type, gender, and phone number. After that, click on “Save and Next”.

- Similarly, complete filling in further information and choose account configuration.

- After completing these steps, give a declaration and your account will be ready to start trading.

Alternatively open your Account right here:

Note: Your capital is at risk

FP Markets Fees

CFD Fees

Stock Index CFD fees on FP Markets are low, but the stock CFD fees are high. For a long position of $2,000 held for one week, FP Markets CFD fees are

| CFD | Fees |

| S&P 500 index CFD | $0.0 |

| Europe 50 index CFD | $1.7 |

| Apple CFD | $32.9 |

| Vodafone CFD | $27.6 |

FP Markets charges a commission when a user trades stock CFDs, as mentioned below

| Market | Commission per trade | Minimum fee |

| NYSE, NASDAQ | $0.02 per stock | $15 |

| London | 0.10% of the trade value | £10 |

| Frankfurt | 0.10% of the trade value | €10 |

| Australia | 0.08% of the trade value | AUD 0 |

| Singapore | 0.15% of the trade value | SGD 25 |

| Hong Kong | 0.30% of the trade value | HXD 100 |

Forex Fees

Forex fees on FP Markets are low. The commission may vary based on the type of account you opt for. The ECN Raw account costs include a lower spread cost along with a $3 per lot per trade commission. The spread cost would be higher if you select the Standard account, but no commission.

Look at the table below to know forex benchmark fees on the broker for a $20,000 long position at 30:1 held for a week

| Currency Pair | Benchmark Fee |

| EURUSD | $5.3 |

| GBPUSD | $4.2 |

| AUDUSD | $3.9 |

| EURCHF | $1.4 |

| EURGBP | $6.1 |

Stock Fees

FP Markets provides its clients with the access to real stocks, but only to those on the Australian Securities Exchange. The fees are different for each account type

| Account | Commission | Minimum Fee |

| Standard | 0.11% | $14.95 |

| Non-Leverage CFD | 0.8% | No minimum |

Deposit Fees

FP Markets does not charge any deposit fees. The broker covers internal bank fees for all international deposits. If they receive a receipt that shows that the original deposit fee amount is equal to or less than $50, they cover clients’ international bank fees for deposits more than $10,000.

Withdrawal Fees

FP Markets does not charge any additional internal fees for withdrawals. However, payments to and from overseas banking institutions can attract intermediary transfer fees from either party that are independent of FP Markets. The broker does not accept responsibility for any bank fee. FP Markets charges 10 AUD of internal fees for international withdrawal.

Non-trading Fees

Non-trading fees on FP Markets are low. The broker does not charge account fees or inactivity fees. However, the scenario is different if you are IRESS trader. You will be charged a monthly commission of $55, unless you hold a balance of AUD 50,000 or generate at least AUD 200 monthly.

Deposit and Withdrawal Method

The deposit methods on FP Markets are

| Deposit Method | Accepted Currencies | Deposit Time | Deposit Fees |

| Credit/Debit Card | AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD | MT4/5: Instant funding Iress: 1 business day |

No fees |

| Swift Bank Transfer | All currencies | 1 business day from when the funds are received | No deposit fees charged from FPM. FPM covers international fees up to $50 for deposit more than $10,000 |

| Neteller | AUD, CAD, CHF, EUR, GBP, JPY, PLN, SGD, USD | MT4/5: Instant funding Iress: 1 business day |

No fees |

| Skrill | AUD, CAD, EUR, GBP, INR, USD | MT4/5: Instant funding Iress: 1 business day |

No fees |

| PayTrust88 Local Bank Transfer | MYR, IDR, THB, VND | MT4/5: Instant funding Iress: 1 business day |

No fees |

| NganLuong.vn | VND | MT4/5: Instant funding Iress: 1 business day |

No fees |

| FasaPay | USD, IDR | MT4/5: Instant funding Iress: 1 business day |

No fees |

| Broker to Broker | AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD | 1 business day from when the funds are received | No deposit fees charged from FPM. FPM covers international fees up to $50 for deposit more than $10,000 |

| South American payment Method (Directa24) | USD | 1 business day | No fees |

| @dragonpay | PHP | 1 business day | No fees |

The withdrawal methods on FP Markets are

| Gateways Withdrawal | Accepted Currencies | Withdrawal Fees | Withdrawal Time |

| Credit/Debit Card | CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD | No fees | 1 business day |

| Domestic Bank Wire | AUD | No fees | 1 business day after all correct documents are received |

| International Bank Wire | Other than AUD | 10 AUD | 1 business day after all correct documents are received |

| Neteller | AUD, CAD, CHF, EUR, GBP, JPY, PLN, SGD, USD | 2% max. 30 USD per 45,000 USD transaction | 1 business day |

| Skrill | AUD, CAD, EUR, GBP, INR, USD | 1% + country fees if applicable | 1 business day |

| FasaPay | USD, IDR | 0.5% | 1 business day |

| PayTrust88 Local Bank Transfer | MYR, IDR, THB, VND | 1.5% | 1 business day |

| NganLuong.vn | VND |

FP Markets Minimum Deposit

The minimum deposit for a trading account depends on two important factors. Depending on the assets you are willing to trade, you can opt one of the two options. The first one is opening an account on MetaTrader platforms for forex trading. The other option is going for stocks and CFDs on the Australian Securities Exchange and opening an account on the IRESS platform. For MetaTrader standard accounts, the minimum deposit is $100, while for the same standard on the IRESS platform; you will need to deposit at least $1,000.

FP Markets Trading Platform

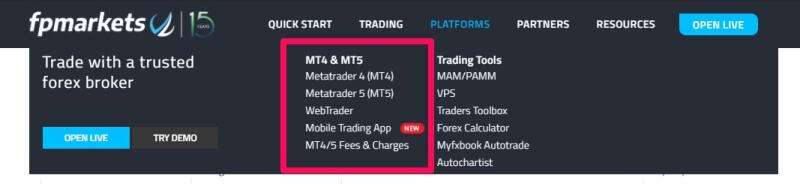

FP Markets offers a bunch of trading platforms, including

MetaTrader 4 for Windows

The MetaTrader 4 trading platform features

- Customisable interface including colours of technical indicators

- Live price streaming on live accounts and demo accounts

- 128-bits encryption for secure trading

- MarketWatch

- Expert Advisors

- One-click trading

- Customisable alerts

- Compatible with iOS, Mac devices, and Android

- Access to MetaTrader market and MQL4 community

MetaTrader MT4/MT5 WebTrader

FP Markets MT4/MT5 online WebTrader makes trading easy and flexible. You can simply trade from your preferred browser on the device of your choice with no OS preference. There is no need to download or install this trading platform either as it can be accessed directly from a browser.

The features of MT4 and MT5 WebTrader platform include:

- Trade forex, Indices, Cryptocurrencies, Share CFDs, and Commodities

- Spreads from 0.0 pips and leverage up to 500:1

- Global

- ECN pricing and no requotes

- Complete suite of trading tools and operations

- Ease of trading (Requires no download and trading starts in seconds)

- One-click trading

- Trade from anywhere

- Real-time price quotes

- Multiple order types and execution modes

- Data synchronisation across all platforms

- Depth of market feature

- Multiple language support

- Online support 24/5 and personal account manager

MetaTrader 4 for Mac OS

- Trade on tight raw spreads from 0.0 pips

- Access to a complete set of trade orders including pending orders

- Powerful leverage up to 500:1

- The ability of running all expert advisors (EAs)

- Advanced real time charting and access to complete technical analysis functionality

- A wide range of in-built indicators

MetaTrader 4 for iOS and Android

You can use the MetaTrader 4 iPhone, iPad and Android app offered by FP Markets anywhere and anytime. With this easy-to-use and technologically advanced platform on your mobile device, trading gets a lot easier. Apart from the MetaTrader 4 features mentioned above, the iPhone, iPad and Android features include

- Advanced and interactive charts with easy scrolls and zooms

- User-friendly interface with trade levels and volumes on a chart

- The ability to view full forex trading history

- Easy to download iPhone and iPad app directly from the Apple store

FP Markets Mobile Trading App

You can trade forex and CFDs across shares, commodities, indices, futures and cryptocurrencies whenever, wherever, and however you want from the FP Markets trading app. The features of the trading app include

- Trading instruments over 60 currency pairs featuring all major currencies

- Access to the most popular companies in the world across global exchanges like the NYSE and FTSE

- Trading tools including stop-loss, take-profit limits, charting tools for conducting market analysis and technical indicators

- Full account access from the app including depositing funds and changing leverage levels

- Top-notch liquidity with real time pricing

- Easy funding with a range of deposit and withdrawal options

FP MARKETS APP

IRESS ViewPoint

The IRESS ViewPoint is another trading platform of FP Markets that has advanced functionalities in order to enhance the trading experience with advanced trading tools and better compatibility with various internet browsers. IRESS Suite has compatibility with the latest browser versions and it allows an automatic data sync between IRESS ViewPoint and IRESS trader.

Details about FP Markets Customer Service

You can contact FP Markets via phone, email, and live chat. One of the best features of FP Markets customer service is the number of available languages. You may choose from Arabic, English, Greek, Chinese, Indonesian, French, Portuguese, Italian, Spanish, German, Malaysian, Vietnamese, and Thai.

Bonuses and Promotions

FP Markets is a fully regulated broker. Hence, it does not offer bonuses on the trading accounts. However, the clients may get two promotional offers in the form of a cash bonus, if the broker decides to offer them, and if the clients are eligible. These promotional offers are

Welcome Bonus

FP Markets may offer new MetaTrader 4 clients a promotional offer in the form of a cash bonus known as the welcome bonus. This welcome bonus is directly notified by the broker via phone, email, or online advertisement.

Eligibility: It is only available to new clients who have been offered the bonus by the broker and pass all compliance and requirements regarding account opening. They must agree to FP Markets terms and conditions, financial services guide, and product disclosure statement. The broker holds the right to accept or reject any application to open a trading account. It does not accept fraudulent, multiple, or incorrectly completed applications. The welcome bonus is available to each individual client only once. This bonus cannot be used in conjugation with any other offer of FP Markets, unless the broker specifies it. Clients who open account under an existing introducing broker, money manager, PAMM/MAMM, or affiliate agreement cannot avail the welcome bonus.

Deposit Bonus

FP Markets may offer all new MetaTrader 4 and MetaTrader 5 clients a promotional offer in the form of a deposit credit known as the deposit bonus. Like the welcome bonus, the broker directly notifies the clients of the deposit bonus amount via online advertisement, email or phone.

Eligibility: The deposit bonus is available only to the clients who have been offered the bonus by FP Markets and pass all account opening requirements and compliance including agreeing to FP Markets terms and conditions, product disclosure statement and financial services guide. The trader must open a Standard or Raw MetaTrader 4 or MetaTrader 5 account. They must also deposit a minimum of $100 or equivalent funds with FP Markets to a maximum of $25,000. Keep in mind that the deposit bonus is only applicable to initial deposits. It is not available for any further deposits, unless specified by FP Markets. You cannot transfer this bonus between accounts. The deposit bonus was open the last time for three months from December 7, 2018 to March 31, 2019. There is no further extension or modification of this promotional offer, unless specified by the broker.

FP Markets Unique Features

|

The unique features of FP Markets include

|

Education

Professional CFD traders of FP Markets have developed several eBooks containing guidelines for traders to study market conditions, predict outcomes, construct and evaluate trades. First, Spot Opportunities in volatile markets help traders to identify trends and spot opportunities when volatile markets are difficult to predict. Moreover, technical analysis offers a guide to some charting and technical tools that the best traders use to minimize risks and maximize profits. Lastly, fundamental trading offers a broad idea of the interrelationship between the markets and global economy. The broker also offers educational videos on its website so traders can learn how to use the MetaTrader 4 platform. You will find a trading course, trading glossary, and newsletters on the website as well.

Research

FP Markets offers several great research tools, such as

Forex VPS Service: Thanks to the VPS hosting of FP Markets, forex traders are allowed to run automated algorithmic strategies without worrying about their trades being ruined by downtime or trading platform issues. It offers remote access through standard Windows remote desktop connection software or its mobile platform. Therefore, power bills are reduced because devices can be turned off when they are not in use while still having automated trading strategies executed on time and accurately. Moreover, the VPS hosting is always on for state-of-the-art technology to make sure that traders can enjoy seamless experiences anywhere and anytime.

Traders Toolbox: FP Markets MT4 Trader Toolbox contains 12 online trading tools that prove solid trading infrastructure and valuable market insights in order to enhance the trading experience.

Forex Calculator: FP Markets forex calculator is an all-in-one tool that calculates all important parameters of trading like contract size, pip value, margin, swap, and potential profit across a range of products.

While these research tools are very useful, the charts have areas of improvement in design and user-friendliness.

FAQ

Yes, FP Markets offers ECN-pricing for the execution of trades.

Market makers usually have a lower minimum deposit, low to no commission on trades, and smaller minimum trade requirements. FP Markets matches this criteria, thus, it is a market maker.

Not only FP Markets is globally regulated by FSP, ASIC and CySEC, but it is also fully licensed and regulated by SCB. The broker also offers tighter spreads from 0.0 pips on its platforms. Its ECN pricing model is also transparent. Thus, FP Markets can be considered a reliable forex broker.

FP Markets offers a vast range of deposit and withdrawal options. You can deposit and withdraw from FP Markets by credit/debit cards, local bank transfer, electronic wallets, or broker to broker transfer.

Yes, FP Markets offers a demo account.

Note: Your capital is at risk