IC Markets Review 2025 for South Africa - Scam or Safe?

One of the most popular forex CFD providers, IC Markets offers trading solutions for beginners, active day traders, and scalpers. Clients are provided with cutting edge trading platforms, superior liquidity and low latency connectivity by IC Markets. With this broker, you can get access to the pricing which was only available only to the high net worth individuals and investment banks before.

One of the most popular forex CFD providers, IC Markets offers trading solutions for beginners, active day traders, and scalpers. Clients are provided with cutting edge trading platforms, superior liquidity and low latency connectivity by IC Markets. With this broker, you can get access to the pricing which was only available only to the high net worth individuals and investment banks before.

Overview:

- Minimum Deposit: 200$

- Maximum Leverage: 1:500 (T&C Apply)

- Tradable Assets: Forex, Indices, Commodities, Stocks, Bonds, Cryptos, Futures

- Regulated by FSA (Financial Services Authority), ASIC & CySec

- Demo Account: Yes

Note: Your capital is at risk

License and Regulation

IC Markets is regulated and authorised by the FSA (Financial Services Authority) of Seychelles. You must know that FSA is one of the strictest financial regulatory bodies in the world, so, its monitoring makes IC Markets a safe place for traders. Besides FSA it is regulated by ASIC and CySec too.

Registration

Registering on IC Markets is fast and easy. You can easily open a live account on the website.

To open a live account –

- Click on the option “Start Trading”.

- You will be redirected to the page for opening a live account.

- Fill in your personal details; let the broker know more about you, trading account configuration and declaration.

- Complete each step by clicking “Next: and “Register” at the end.

- After that, you can fund the account and start trading.

- When it comes to opening a live account, you can also sign up with your PayPal account.

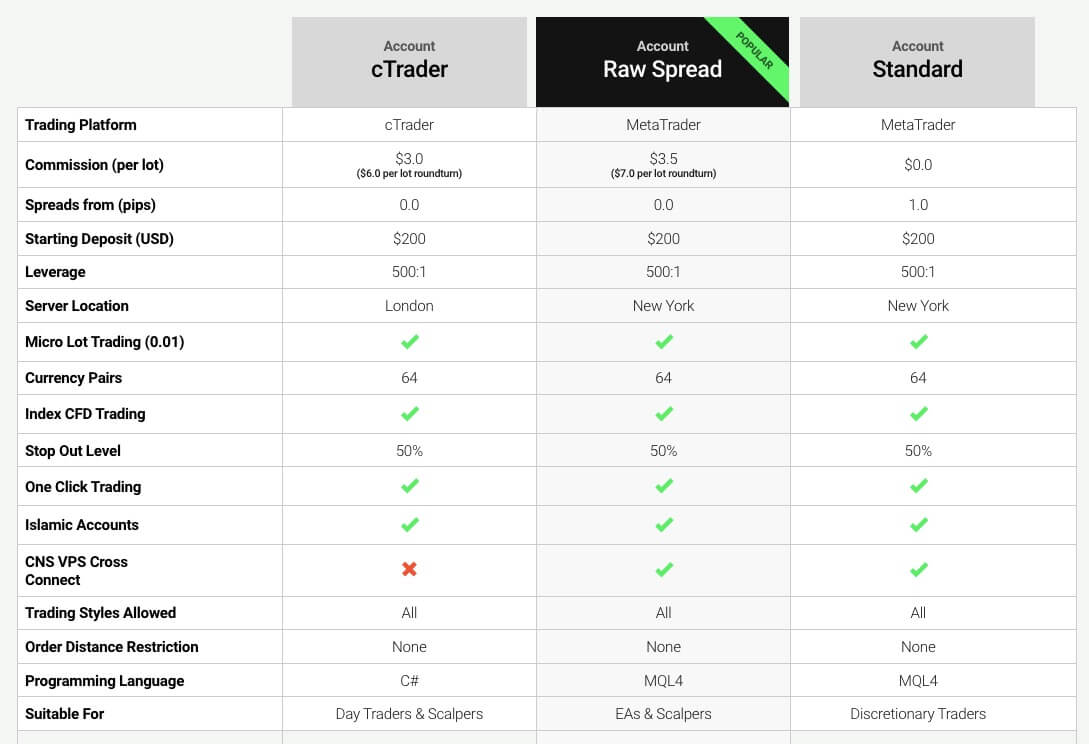

IC Markets Account Types:

There are three different types of accounts on Vantage FX. You may choose from:

- Raw Spread Account: The Raw Spread account on IC Markets offers the lowest possible spreads to traders. The average EUR/USD spread is 0.1 pips. The commission per lot per side is a small $3.50. With fast execution and deep liquidity, the Raw Spread Account is designed for expert advisors, day traders, and scalpers. The trading platform for this account is MetaTrader.

- cTrader Raw Account: IC Markets cTrader account is designed for forex CFD trading. Built for demanding performances, cTrader Raw account is combined with IC Markets Raw pricing and excellent execution speeds. The trading platform for cTrader Raw Spread is cTrader. Commission is $3.0 per $100K. The average spread starts from 0.0 pips.

- Standard Account: IC Markets standard account offers excellent speed of execution. By combining this with the spread starting from 1 pip, you can enjoy an unparalleled trading experience. The commission per lot per size on this account is $0. The trading platform is MetaTrader.

- Islamic accounts: IC Markets also offers Islamic accounts for traders of Islamic faith who cannot pay or earn interest because of their religious beliefs. Also known as swap-free accounts, these accounts allow traders to apply for an account without crediting or debiting any interest fee. This swap-free option is available on both standard and Raw Spread account types on cTrader, MetaTrader 4 and MetaTrader 5. You can trade more than 90 instruments on these accounts. Only a flat rate financing charge is applicable for trades that are open more than a day.

Trading Conditions

- Minimum deposit: USD $200 or currency equivalent.

- Minimum investment: Minimum trading amount is 0.01 lots per trade

- IC Markets spreads and fees: 0.0 pips, 0.1 pips, and 1 pip.

Instruments

IC Markets Forex Trading

The traders on IC Markets are provided with the opportunity of trading 24 hours a day and 5 days a week on the forex market. Traders are given the benefits of the superior execution, deep liquidity through 60 currency pairs, and tightest spreads. You can trade 60 currency pairs on tight spreads from 0.0 pips with up to 1:500 leverage (T&Cs Apply) and deep liquidity.

IC Markets Indices CFD Trading

IC Markets offers global indices CFDs to traders for getting exposure to the largest equity markets in the world. You can have a broader view of the equities market with spreads from 0.5 points on 16 indices. Moreover, traders can also enjoy trading across major markets 24/5 without commission. You may trade on MT4, MT5 and cTrader with no commissions and up to 1:200 leverage. (T&Cs Apply).

IC Markets Commodities CFD Trading

With IC Markets, you can trade agriculture, metals, and energy like a Futures CFD or a currency pair against the USD. The broker combines flexible lot sizes from 10c per point with tight pricing. Thus, they are able to provide traders with one powerful product. You can trade more than 19 commodities with up to 1:500 leverage. (T&Cs Apply)

IC Markets Stocks CFD Trading

You can access more than a hundred large-cap stocks CFDs across the NYSE, NASDAQ and NYSE stock exchanges. IC Markets have chosen the most popular companies in the world, so the traders are provided with the best trading opportunities.

IC Markets Bonds CFD Trading

Traders are offered the opportunity of speculating on interest rates, as well as global risk-on/off sentiment with bonds. They can also diversify their strategy and hedge equities exposure. With IC Markets, traders can choose from a wide range of bonds that are issued by governments around the world including the U.K, the U.S, Europe and Japan. More than 6 bonds are available to trade with up to 1:200 leverage (T&Cs Apply), no commissions and deep liquidity.

IC Markets Cryptos CFD Trading

You can trade the largest and most popular cryptocurrencies in the world long-term or short-term with IC Markets. Traders can trade 24 hours a day, and 5 days a week against other retail traders. Factors like news, prevailing sentiment, greed and fear drive price movements primarily. Trading can be enjoyed with leverage up to 1:5 (T&Cs Apply). You can also eliminate the risk of cryptocurrency exchange by trading with a CFDs provider regulated by ASIC.

IC Markets Futures CFD Trading

IC Markets also offers a range of Futures CFD which is one of the most popular forms of CFDs in the world. Four global futures are available on this broker to trade, including the ICE Dollar Index and CBOE VIX Index. The MetaTrader 4 platform of IC Markets offers online futures-based CFDs exclusively. The benefits of this market are that it has deep liquidity and no commissions. You can trade with up to 1:200 leverage. (T&Cs Apply)

Trading Platform Review

IC Markets Trader MT4/MT5

IC Markets provides the traders with the award-winning MetaTrader 4 and the next generation MetaTrader 5. It offers traders everything they need for trading, from easy usability, automated trading ability and feature-rich environment. MetaTrader is not only a trading platform but it has become a global community for traders. Innovating technology like advanced charting and sophisticated order management tools help traders managing their trades like a pro.

System requirements

To use MetaTrader 4 or MetaTrader 5 client terminal, you need Windows OS 7 or higher. You can also run these on a Mac OSX.

Features

- Raw pricing: Through the MT4 and MT5 platform, IC Markets offers clients the best possible pricing, as well as the best trading conditions and tight spreads with Raw pricing. You can trade on institutional grade prices almost equal to the world’s leading execution venues. With up to 25 different prices provides, it becomes the top choice for high volume trade.

- Fast order execution: The IC Markets MT4 and MT5 servers are in the Equinix NY4 data centre in New York which is named as a financial ecosystem with more than 600 buy and sell side firms, trading venues, service providers, exchanges and market data. It ensures that the servers are cross connected, so traders are provided with low latency and fast execution. In average, the MT4 and MT5 servers have latency lesser than 1 millisecond, which is ideal for automated and high frequency trading.

- No restriction on trading: There is no restriction on trading when it comes to IC Markets MT4 and MT5 platforms. Offering the ideal trading conditions for high frequency trading and scalping, IC Markets allows traders to place orders between spreads with a freeze level of 0 and no order distance. So, you can place stop loss orders as close to the market price as you want. Moreover, there is not FIFO (First in First Out) rule in IC Markets, so, traders can also hedge positions and enjoy the benefits of margin netting without paying margin on hedged trades.

IC Markets MetaTrader Webtrader

Traders can access their MT4 or MT5 trading account from any web browser by using IC Markets MetaTrader WebTrader. With MetaTrader WebTrader, you are provided with fast order execution and convenience of web-based application with no dealing desk. It has the same one-click trading, level II pricing and tight spread like the MetaTrader desktop version along with a personalised trader dashboard to monitor your positions.

System requirements

To use MetaTrader WebTrader, you need browsers like Chrome, Firefox, IE 10+ and Firefox.

Features

- Raw spreads

- No restrictions on order or trade

- Trade from any location

- Level II pricing – full market depth

- Multiple order types

- Leverage up to 1:500 (T&Cs Apply)

- Micro lots 0.01 without maximum

- Technical analysis and advanced charting

- One click trade execution

- Real time trade reporting

Benefits

- Trade without the intervention of dealing desk

- The fastest possible execution with ultra-low latency

- Greater control over risk with micro lots

- All major browsers supported

- Saving money every time while trading with low costs

- Choosing leverage suited to individual strategy and trading style

- Moving money in and out of trading account easily

- The convenience of using the same account on MetaTrader and MetaTrader WebTrader

cTrader

Combined with the speed of high performing trading platform and the deep liquidity of IC Markets, cTrader platform offers clients the ultimate trading solution. You can access deep liquidity in 64 currency pairs and also 16 major liquidity indices. The superior functionality and streaming prices from multiple global banks make traders around the world appreciate this platform.

System requirements

To use IC Markets cTrader platform, the minimum system requirements are dual core CPU processor, Windows 7 OS, and 2 GB memory.

Features

- Extremely low spreads: Traders can enjoy the tightest spreads on IC Markets. You can often see spreads from 0.0 pips on the EUR/USD. The average spread in 0.1 pips 24 hours and 5 days.

- Fast order execution: IC Markets cTrader server is situated in the LD5 IBX Equinix Data Centre in London. Referred to as a financial ecosystem, it houses over 600 buy and sell side firms, trading venues, exchanges, service providers and market data. By cross connecting the server, it provides traders with fast execution and low latency of 1 MS.

- Level II pricing – market depth: Due to the depth of the market of cTrader, traders can see the full range of executable prices that come directly from the price aggregator of IC Markets. You can use the VWAP (Volume Weighted Average Price) to fill in orders in IC Market’s bridge against the full order book. cTrader platform also provides complete transparency for each currency pair because you can see the available volumes for each price level anytime. You are ensured the tightest possible spreads with high liquidity, guaranteed low latency and asynchronous spot prices.

- Smart stop out: The smart stop out logic is designed to provide the traders’ accounts with maximum protection. cTrader’s fair stop out logic will be replaced by it as it offers significant benefits to traders by using an advanced algorithm. When margin level falls below the smart stop level, you will see positions closing partially. Thus, it can restore the margin level safely and protect the position, the entry point and the trading account.

Social Trading with Zulutrade

ZuluTrade is one of the most popular social trading platforms in the world. There are about 100,000 talented ZULU traders that come from 192 countries. You can connect with them and follow their trading signals for free.

Features

- ZULU rank: It offers a sophisticated algorithm that analyses the overall performance, maturity, stability, exposure, and required equity of signal providers and rank them accordingly.

- ZULU guard: ZuluTrade offers a highly advanced account protection feature to traders. It monitors the performance of trades 24/7. Whenever needed, ZULU guard will step in to protect the invested capital of a trader.

- Simulation: It is a powerful tool of this social media platform that helps traders in testing the potential profits and losses on the account. You can check your potential performance and strategies before going live.

MAM

IC Markets multi account manager allows money managers to manage the money of their clients with real-time reporting of commissions and performance, as well as flexible allocation. The MAM software connects all allocations settings with the MetaTrader 4 server directly. So, you only need to worry about trading through MetaTrader 4 master accounts. MAM software takes care of all other processes. This platform is ideal for people that use expert advisors.

Features

- Real time adjustment of trading parameter

- Unlimited deposit accounts and trading accounts

- Allocations to accounts at little lots like 0.01

- All normal and unique order types accepted

- Full, mini and micro lot accounts trade for best allocation advantage

- Managing multiple master accounting using different strategies

- Sub accounts having outputs to screen reports

- Allowing EA trading of managed accounts of clients

- Market watch window within MAM

- STP on master accounts for executing bulk order and instant allocation to sub accounts

- Monitoring performance and commissions in real time

- Client reports management monthly, quarterly and annually through MetaTrader manager

- Real time order management monitoring within MAM

IC Markets App – Mobile Trading with IC Markets

Apart from web browsers on desktops, you can also trade with IC Markets on your mobile devices with its apps. These are the apps available for you –

MetaTrader for iPhone and iPad

System requirements - Compatible with iPhone, iPad and iPad touch. You need to have iPhone iOS 7.0 or later.

MetaTrader for Android

System requirements - Android 4.0 or higher

Features of MetaTrader for iPhone/iPad and Android

- Real time forex and CFD quotes

- Full set of trade orders and pending orders

- Supporting all types of execution modes

- Real time interactive charts with scroll and zoom

- Multiple timeframes for analyzing patterns and price action

- Technical indicators settings adjustability

- Trading from the chart directly

- The convenience of viewing complete trading history

- More than 30 most popular technical indicators

- Three chart types such as line, bars, and Japanese candlesticks

MetaTrader for Mac

System requirements - Mac OS X 10.x and above

Features of MetaTrader for Mac

- Full range of custom built indicators

- Benefits from all MetaTrader features

- Advanced analysis functionality and charting

- Full set of trade orders, as well as pending orders

- Compatibility with all expert advisors

cTrader for iPhone and iPad

System requirements - iPhone iOS6 and later.

cTrader for Android

System requirements - Android 4.1 and later.

Features of cTrader for iOS and Android

Trading features

- Fast execution for commodities and forex

- Full information on balance, P&L and margin

- Available charts

- Order execution by single-tap

- Viewing all rates and symbols

Accounts features

- Gaining access to complete list of accounts and switching accounts with a single tap

- Viewing and modifying pending orders

- Viewing trading history

cTrader for cAIGO

System requirements -. Net4, Windows OS XP, Vista, 7, 8 and 10

Language support: Arabic, Chinese, English, French, German, Greek, Hungarian, Italian, Japanese, Korean, Polish, Portuguese, Russian, Spanish, Turkish and Vietnamese.

Features

- Developing algorithmic trading systems

- Customised technical indicators for technical analysis

Deposits and Withdrawals

IC Markets offers more than 15 flexible options to deposit money and fund your account. You can deposit in ten different currencies using a range of methods. The process of the deposit is fast and free.

Funding options: Funding options on IC Markets include Credit and Debit Cards, PayPal, Neteller, Neteller VIP, Skrill, UnionPay, Wire Transfer, Bpay, FasaPay, Broker to Broker, POLI, Thai Internet Banking, Rapidpay, Klarna, Bitcoin Wallet, and Vietnamese Internet Banking.

Currencies: Currencies you can deposit are AUD, USD, EUR, CAD, GBP, SGD, NZD, JPY, HKD, and CHF.

Please note

- Account holders must deposit funds into their account and submit withdrawal requests from inside their secure client area for faster processing.

- All payment information is confidential and encrypted.

- Account holders do not need to pay any additional fees for deposits or withdrawals.

- No payment from third parties is accepted.

- Cut off time for withdrawal requests in 12:00 AEST/AEDT.

- Credit/Debit card withdrawals are processed free of cost and take 3-5 business days.

- A processing fee of 20 AUD or equivalent currency is charged for international bank wire transfers.

- Safecharge withdrawals can revert the deposited amount.

IC Markets Demo Account

With IC Markets, if you are a beginner in trading, then you can first open a demo account before opening a live account.

To open a demo account –

- Click on the option “Try a Free Demo.”

- You will be redirected to the demo account application page. Fill in your personal details here.

- Fill in your country, name, email and phone number.

- You may choose if you want to receive the newsletter and special offers and if you were referred by an introducing broker.

- After that, you can click on “Register” and then proceed to trade account configuration.

Education

The official website of IC Markets divides trading different instruments on different platforms in organised categories so traders can learn and educate themselves on trading. The help centre and video tutorials provided on the site are also very helpful for self-training. Apart from this, IC Markets offers online education and conducts educational webinars on various topics. The dates and times of webinars are published on their blog.

IC Markets Bonus and Special Offers

IC Markets is offering no Bonus Deals.

Customer Service and Support

IC Markets offers friendly customer service and support 24/7 via call, email and live chat. You can also visit the help centre of the website where most frequently asked questions, questions about IC Markets, trading with IC Markets, forex market, MetaTrader 4 problems, trading platforms, trading forex CFDs online, account application, and client area are answered.

Conclusion: Should I trade with IC Markets?

Under the regulation and supervision of FSA, IC Markets is one of the safest places to trade online. You can trade a large number of instruments with this broker in several currencies. Moreover, it offers numerous benefits to account holders like deposits and withdrawals without additional charges, fast execution of a trade, the confidentiality of information and more. With the legendary MetaTrader 4 and MetaTrader 5 trading platforms, IC Markets takes trading to another level. So, if you are looking for a broker to trade, IC Markets in your ideal choice.

Best features of IC Markets

|

|

Q&A – IC Markets Questions

IC Markets is regulated by FSA, ASIC and CySec which are very strict financial regulatory bodies and are monitoring brokers closely. So, it is definitely not a scam.

On the top-right corner of the website, you can find the button “Client Login”. You can log in to your account by clicking on it after registering yourself.

YC Markets offers leverage from 1:1 to 1:500. (T&C Apply)

No, currently IC Markets does not offer any types of no deposit bonus or welcome bonus.

Yes, IC Markets MetaTrader is available to download on iPhone, iPad, Android, and Mac. IC Markets cTrader is available for iPhone, iPad, Android and cAIGO.

If minimum trading volumes are met, then IC Markets can sponsor up to USD $35 per month for VPS.

Yes, the payment method with PayPal is available on IC Markets.

Note: Your capital is at risk