Markets.com Review - Ratings, Bonus, Demo & More

Among all online brokers who offer different types of online trading to brokers, a Cypriot firm has been making rounds for the past few months among the investor and trading communities around the world. The site we will be focusing here is Markets.com, a brand and trademark owned by Safecap Investments Limited. The company’s registered address is ay 148 Strovolos Avenue, 2048 Strovolos, P.O. Box 28132, Nicosia, Cyprus. They have a very responsive Trading desk, with competent customer service associates who can be reached at +357-2-203-0583

Overview:

- Minimum deposit: $100

- Max. Leverage 1:300

- Tradable assets: +2000

- Regulated by: FSB and others

- Demo Account: Yes

Note: Your capital is at risk

License & Regulations Review

According to their Website briefing, Markets.com, owned by Safecap Investments Ltd. is registered as a regulated investment service firm, authorised under the Cyprus Securities Exchange Commission or CySEC, with the license number 092/08. Additionally, since it also operates in the South African markets, it is regulated by the Financial Services Board or FSB in South Africa as a Financial Services Provider. The markets.com brand is a global one owned by Safecap as well as Trade Tech Markets Limited. Both the “Safecap” and the ”Markets” brand names are subsidiaries of Playtech PLC, a company traded on the London Stock Exchange's Main Market and a constituent of the FTSE 250 index.

markets.com stands out among the rest of the competition by providing special protection mechanisms for traders from select countries. Measures such as Stop-loss automation as well as other additional trading restrictions are imposed according to applicable local laws. You can read about their Investment Services Agreement here. However, markets.com does have some restrictions when it comes to providing their services. The service is not authorised in Japan, Canada, USA and Belgium.

Cypriot based firms, although previously embroiled in controversies have come a long way. This is due to the fact that Cypriot Financial Authorities have increased the rigidity of rules that apply to online Forex Brokers.

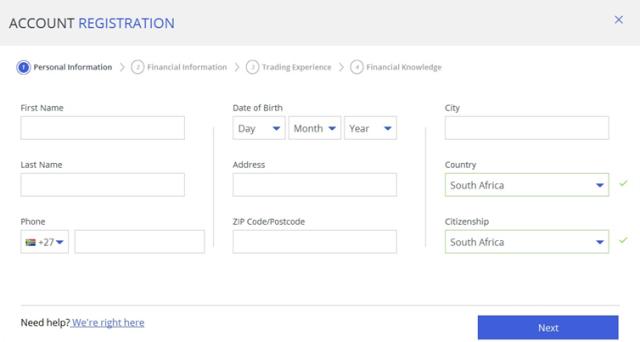

Registration

The registration process in markets.com is quite easy. At first the potential user will have to provide their email id or Facebook id and then input a password. By default the Account Currency will be given as USD but the trader can change it.

An account will be created and it will take the trader to the next page where a dialog box will ask the trader to complete the registration process. Click on “Proceed” to continue.

The personal information page will open in a dialog box. Fill in details like name, address, phone number, zip code and nation.

It will lead to the financial information slot where the trader has to state their level of education, field of study and employment status. The pop-up will also ask annual income, savings and investments, and the amount the trader intends to invest every year. The next question is the nature of trading the trader wants to do (Speculative Trading, Additional Income Earning, Savings or Other). Source of funds used to trade must be mentioned. The trader will also have to mention whether they hold U.S. citizenship and are liable for taxes.

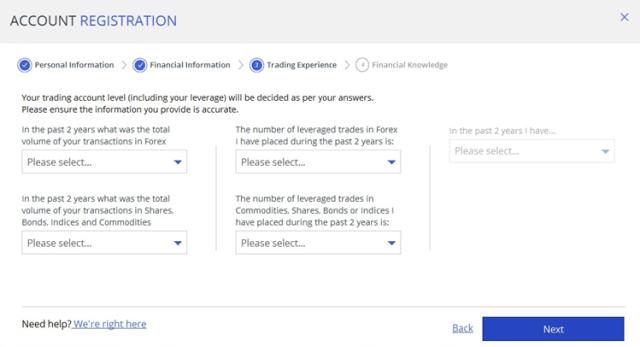

After clicking on “Next”, the trading experience slot will appear. It will ask the questions as seen in the following screenshot.

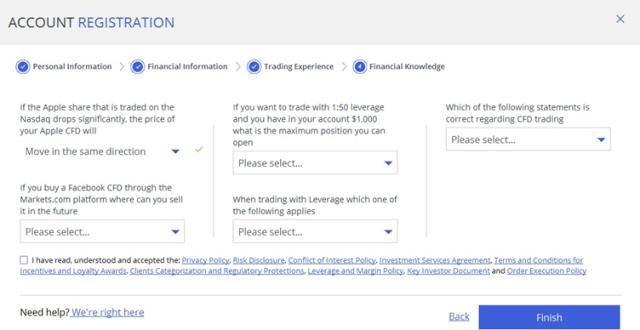

After the trader has submitted the required information, they will have to click on “Next”. The financial knowledge slot will appear where the exchange will test how knowledgeable the user is in trading. A sample has been provided in the following screenshot. After answering all the questions, the user will have to click on the “I have read” box. The final step is to click on “Finish” to complete the Account Registration process. The user can also click on “Back” to review any previous options.

Accounts

Unlike other online brokers who can complicate things by offering a plethora of account options to choose from, markets.com has a singular standard account for all its members. The minimum Deposit for these accounts is $100. Traders can set up an account in a matter of minutes as the process of registration using the necessary compliance documents is seamless and quick. It allows trading in Gold, oil, stocks, commodities, CFDs, currencies and equities, allowing traders to choose and make profits in a variety of different markets. There is also an option of creating a demo account for free, which can help novice traders come to terms with the various nuances of the online trading market.

Opening an Account: As mentioned before, opening an account becomes quite simple and easy, especially for novice traders. Before opening an account, individuals have to enter their personal data, personal financial information, information about past trading experience, etc. A simple test on the person’s financial knowledge is also conducted as an extra safety mechanism. After the above steps have been completed, members have to set a default leverage rate. It can range from 1:300 to as low as 1:50, with an option of modifying preferences at anytime.

Features and Instruments

Markets.com provides a plethora of tools which traders, especially novice traders can take advantage of. They provide chart analysis, oscillators, indicators and other alert services for a seamless trading assessment and experience. We shall now discuss the salient features offered by this particular broker.

Stocks: Just like other similar brokers who offer CFD trading; it’s up to the broker to decide the stocks. This results in a much smaller offering range as compared to a broker who offers direct stock exchange trading. In terms of CFD selections, Markets.com ranks in the middle. For instance, they offer 200 UK stock CFDs but only one Japanese stock CFD. However, the plus point of Markets.com is the degree of service offered to smaller exchanges, for instance, Hungarian Stocks.

ETF Trading: They offer 39 ETF trading options, which when compared to similar brokers falls quite short.

Indices Trading: Markets.com offers their members the chance to trade 27 different indices as CFDS. This is inclusive of most of the largest stock markets and indices in the world like VIX.

Commodity and Currency Trading: Markets.com offers Gold, Oil, Copper and silver trading when it comes to commodities. They also offer a wide range of currency pairs, 55 to be precise, which are also inclusive of some rare national currencies.

The minimum deposit amount is only $100. This encourages the novice traders to open an account on markets.com and they not have to worry about losing too much money in case they lose the trade. Moreover, maximum leverage is 1:300.

Having access to demo account at all times is another beneficial feature markets.com sports. Both the novice and experienced traders can use it to test a trading strategy in a particular market sentiment. This way they will be able to strengthen their trading strategy and apply it on the real market effectively.

Cryptocurrency Trading

As a Markets.com account holder, you can trade Bitcoin in a fast and secure way. Trading Bitcoin Futures CFD with Markets.com is fairly simple, as you don’t need any sort of technical knowledge to trade your assets. Also, you don’t need to install virtual wallets for trading your Bitcoins. Market.com is accessible from both the responsive web trader and the Markets.com mobile app which is available for Android and iOS.

Trading and Non-Trading Fees

Markets.com’s fee structure is competitive in nature as compared to similar services. This is largely reiterated by the fact that their homepage does not provide a clear fee structure description. Another factor would be the involvement of fees in the spreads they offer, which makes the overall fee structure non-transparent.

Trading Platform

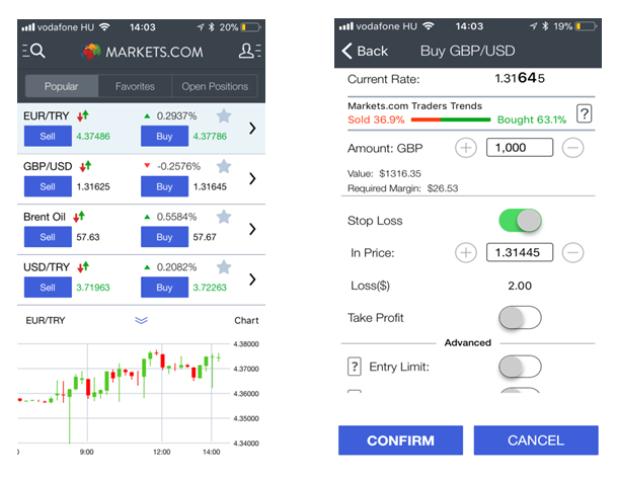

Markets.com offers users trading platforms for both web and mobile use. However, the desktop platform is not a downloadable application.

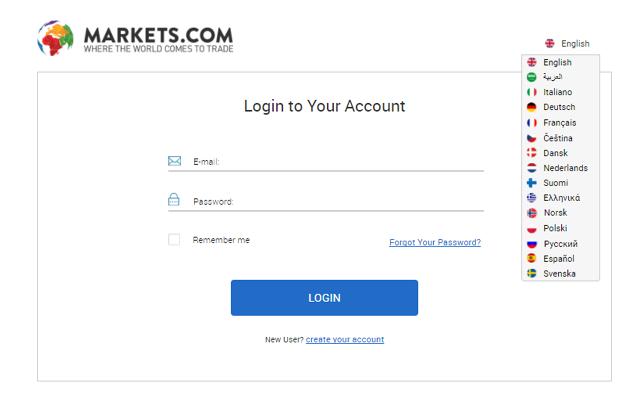

The Web Platform is very easy to operate and navigate around. It has a sleek design that serves the purpose without much complicacy. It has a one-step-username/ password login rule in place of the more secure two-step authentication method.

Some standout features include:

- A header with functions such as depositing funds, live chat, settings and other non-trading functions.

- A Main Panel that offers a host of features

- A news Bar

The Mobile Trading Platform is a nicely designed mobile platform for both iOS and Android systems. The on boarding when a user first logs in is very quick indeed. However, this variant lacks some features which the web platform provides, including, The Mobile Trading Platform is a nicely designed mobile platform for both iOS and Android systems. The on boarding when a user first logs in is very quick indeed. However, this variant lacks some features which the web platform provides, including,

- the economic calendar nor the analyst recommendatio

- No News Viewing

- There are also no alerts

- Cannot add indicators to charts

- Less of the closed positions information

In spite of that the Mobile Platform provides traders the opportunity to stay connected with the market no matter where they are.

Deposits and Withdrawals

Markets.com offers a very flexible and adjustable option when it comes to account deposits. Debit card/Credit card transfers via Visa, MasterCard and Diner’s Club are accepted along with wire transfer options for both deposits and withdrawals. There is also a possibility of choosing local transfer options according to the situation. Other options include PayPal, Skrill, Neteller etc.

Withdrawals are also pretty streamlined, with the user just having to log into an account and click on the “withdraw” tab. The funds are then transferred into a bank account. They do not charge any fees during the whole deposit or withdrawal process, with a reimbursement scheme. This scheme commits to reimbursing the client for any charges incurred to the financial intermediary (like a bank) in deposits that exceed the $2,500. The withdrawal process generally gets completed within 3 working days after a user has initiated the submission of a withdrawal request.

Offers and Promotions

To attract more clients and to provide a safer, more reliable trading experience, markets.com have come up with a policy of empowering their clients to get themselves acquainted quickly to the trading environment. This includes online self-activation without the aid of live customer support. This special policy provides newer traders with walk-through tips, help messages and briefs where necessary. Some additional bonuses are also announced from time to time.

Customer Support

The customer support team is responsible and very accessible to users, with offices located worldwide in 21 different locations. Customer care representatives are also available round the clock through email as well as live chat. To contact the main office for any grievance or special requests, they provide an online form as well. The customer support team is known for offering their services in a wide range of languages, which have enabled them to achieve a BrokerNotes triple AAA support rating.

Languages supported: Arabic, Chinese, Dutch, English, French, German, Italian, Japanese, Norwegian, Polish, Romanian, Russian, Spanish, and Turkish

Best Features at a Glance

|

Some of the best features of Markets.com are summarised below:

|

Conclusion

Markets.com is one of the best options for traders seeking on concentrating solely on CFD trading. Its easy-to-use platform, coupled with a host of different features and tools can make any trading experience a safe and pleasant one. However, on the downside, their fee structure appears to be quite opaque and its only governing bodies are CySEC and FSB. Our final verdict is that it is a good choice for novice traders as there is no inactivity or withdrawal fees involved.

Note: Your capital is at risk