Lots and Leverage in Forex

Foreign Exchange Trading, also known as Forex trading is one of the most heavily traded markets in modern times, where traders hope to earn a profit through speculation of different currency values. Currencies are generally paired up and are called Trading pairs which indicate the value of one unit of currency with another. For example: USD/EUR – The U.S. Dollar against the Euro.

Foreign Exchange Trading, also known as Forex trading is one of the most heavily traded markets in modern times, where traders hope to earn a profit through speculation of different currency values. Currencies are generally paired up and are called Trading pairs which indicate the value of one unit of currency with another. For example: USD/EUR – The U.S. Dollar against the Euro.

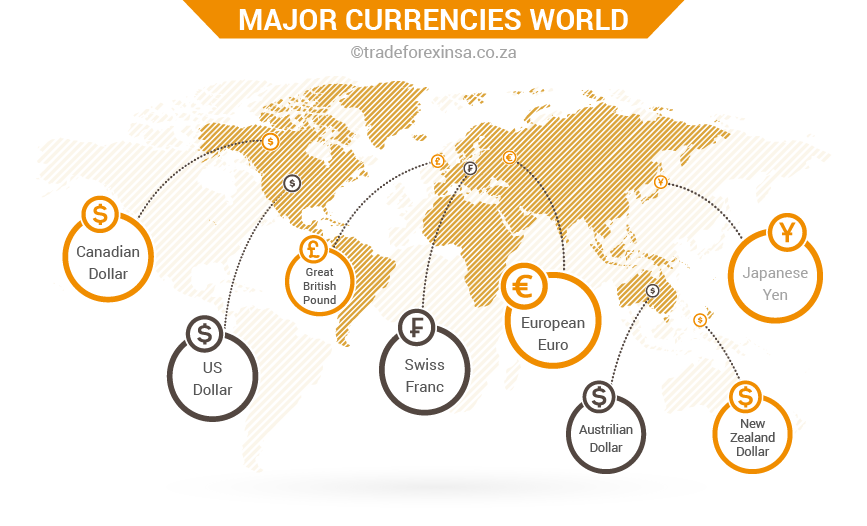

Major Currencies of the World

Trading diligently on Forex markets is not an easy task and takes years of technical knowledge and experience to get it right. Hence it is certainly no place for novice traders who are not clear about the concept. In particular, there are a lot of forex related jargon involved in everyday trading activities, which are to be completely understood by a trader to avoid making precious mistakes and losing fortunes. Among the different terminology available, “Lots” and “Leverages” are important ones which we will explain below.

Lots

In the forex world, a “lot” refers to a standard unit of measurement used by forex dealers around the world to calculate currencies. The majority of the forex dealers operating today offer one standard lot which is equal to 100,000 units of a particular currency.

The size of the lot selected, directly impacts how much a market move affects a trader’s account so that a 100 pip move on a small trade will not be felt nearly as much as the same hundred pip move on a very large trade size. It is thus always advised to use appropriate risk management calculators to determine the desired lot side based on the desired output.

Most forex dealers let their user trade in intervals of 1,000 units. This, however does not mean that the minimum investment amount if $1000 since forex trading has “leverage”. When placing a trade, traders can start with their desired volume to carry out trading.

As mentioned before, the standard lot size is usually considered to be equal to 100,000 units of currency. However, quite recently many forex dealers have started offering Lot options of 10,000 (Mini Lot), 1,000 (Micro Lot) and even 100 units (Nano Lots).

Examples Applied in Trading

To effectively understand the concept of lots, one first needs to understand the definition of Pips in the forex context. A pip refers to the change in the value of a particular currency relative to another one. Usually this figure is a very small percentage of a unit of currency. Trading opportunities in forex revolves heavily around taking advantage of such minute changes in the value of currencies, which requires trades of large amounts of a particular currency. Failure to do so will not serve the purpose as no significant profit or loss can be experienced.

In the following example, we will use 100,000 units or a standard sized lot for simplicity. In this case the pip value of the following currency pairs will result in:

- USD/CHF at an exchange rate of 1.4555: (.0001 / 1.4555) x 100,000 = $6.87 per pip

- USD/JPY at an exchange rate of 119.80: (.01 / 119.80) x 100,000 = $8.34 per pip

- Note: all figures are hypothetical

If the reverse case occurs where the U.S. dollar is not quoted first according to the norms, the formula alters a bit. For instanceIf the reverse case occurs where the U.S. dollar is not quoted first according to the norms, the formula alters a bit. For instance

- GBP/USD at an exchange rate of 1.8040: (.0001 / 1.8040) x 100,000 = 5.54 x 1.8040 = 9.99416 approximately $10 per pip

- EUR/USD at an exchange rate of 1.1930: (.0001 / 1.1930) X 100,000 = 8.38 x 1.1930 = $9.99734 approximately $10 per pip

The conversion process for calculating pip values can differ between brokers, but is always reflective of the true pip value of the currency chosen at the time of trading.

Lot Options

Leverage

The other important aspect of Forex trading is called “Leverage”. Leverage allows a trader, irrespective of their size to effectively trade on the Forex market. Because of leverage, traders do not need a minimum of $ 10,000 to trade currency pairs like the EUR/USD. Typically, currency pairs posses a leverage ratio of 50:1 meaning that a trader can control a large position say $10,000 by investing a small amount, say $250. Leverage is the bait that attracts most forex dealers in the world. However, using leverage in an uninformed way can be disastrous, as it can be the cause for incurring substantial losses in the pursuit of profits.

Leverage Applied in Forex Trading (Example)

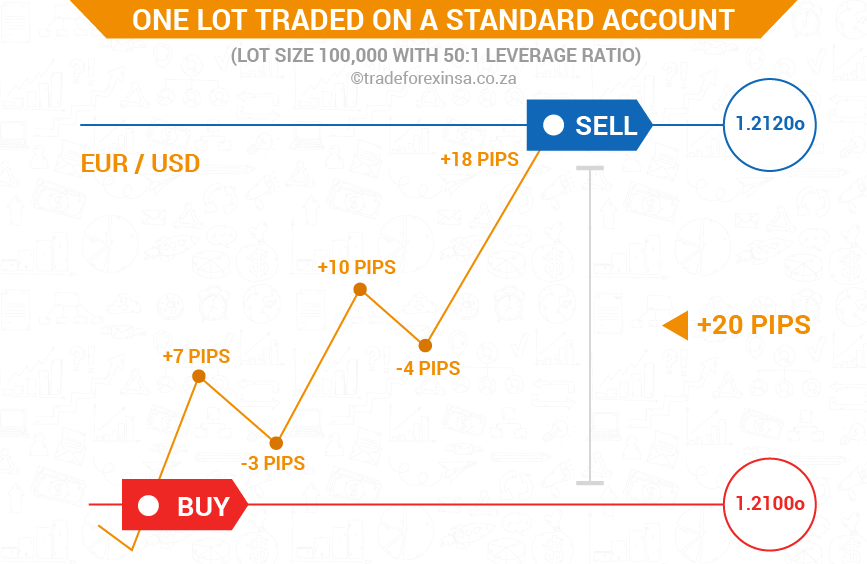

To further understand this concept, we will take the help of an example. In forex trading, the concepts of pips, lots and leverage work together and are interrelated. In our example, a trader purchases 100,000 EUR/USD with a leverage of 50:1.

Then in this case, if a trader purchased it at 1.30000 and closed the trade by selling at 1.30200, the trader is said to have “earned” 20 pips. This can be understood by the formula below used for the calculation:

0.0001 X US$100,000 = US$10 per pip

Thus for a 20-pip trade, the trader earns US $200.

It should be noted that not all pips are equivalent to the example above, as pip value depends on a variety of factors. It relies heavily on the size of the “lot” chosen, the total number of lots being traded, as well as the account currency chosen by the trader himself.

Graphical Representation

Final Thoughts

Forex Trading is one of the most important sectors in the global economy, with thousands of business transactions taking place in every moment of each day. It is estimated that the daily trading volume of forex markets in the world dwarfs that of the worldwide stocks and bond markets, standing at a daily volume of over $5 Million. However, many other factors also determine the strength of a particular currency. Thus, in every exchange, prices need to be corrected and adjusted frequently when one currency is weaker in value than the other. With so many intra-border transactions taking place, it can be very difficult for a novice trader to trade profitably without understanding the core concepts.