What is a Pip?

Being considered as the most liquid market in the world, the trade volume for a day can be as high as $2000 billion USD. The traders can trade forex during any of the 4 Forex trading sessions from any region as all the transactions now occur online. As currency pair is a critical aspect of the Forex market, a pip denotes the measure of change in the price of the quoted currency.

Being considered as the most liquid market in the world, the trade volume for a day can be as high as $2000 billion USD. The traders can trade forex during any of the 4 Forex trading sessions from any region as all the transactions now occur online. As currency pair is a critical aspect of the Forex market, a pip denotes the measure of change in the price of the quoted currency.To understand pips firstly, a short introduction is required about Forex trading. Foreign Exchange or Forex market involves trading currency pairs. It is rather the market for exchanging different currencies to assist international business and trade. For instance, if someone in London wants to purchase a product in the United States then, his euro will first have to be converted in dollars. Being considered as the most liquid market in the world, the trade volume for a day can be as high as $2000 billion USD. The traders can trade forex during any of the 4 Forex trading sessions from any region as all the transactions now occur online. As currency pair is a critical aspect of the Forex market, a pip denotes the measure of change in the price of the quoted currency.

A Brief Note on Basis Point

BPS, the short for basis point is the unit that is used to denote the interest rates and other percentages in the financial market world. 1 basis point = 1/100th of 1% = 0.01% = 0.0001. It is basically used to represent the percentage change in the price of a financial instrument.

In mathematical terms,

1% change = 100 basis point

or

0.01% = 1 basis point

The term ‘basis’ is derived from the base move between two percentages. Basis point also refers to the spread between two interest rates. Generally, the basis is observed as a fraction of a percent as the changes recorded are quite narrow. Moreover, small changes can make a huge change in the forex market. The basis point is mainly used to calculate the changes in the equity indices and interest rates. Bonds and loans are often quoted using basis point as the unit. In the world of trading, the unit basis point makes it easier for the traders, investors and analysts to discuss the change in percentage moves.

Breaking Down “Pip”

Point in percentage or pip is the change in the price of a currency pair in the forex market. A pip is usually measured by taking the quoted currency into consideration but it is also measured in the terms of the base currency. It is a standardized unit, accepted by the world and one pip is the smallest amount by which the price can change. One pip for currency pairs having U.S. dollar as the base currency is usually given as $0.0001. It is popularly referred as one basis point or 1/100th of 1%. One major benefit of having this standardized size of a pip is that it protects the investors from incurring heavy losses. For instance, if a pip consists of 10 basis points then, one-pip change will increase the volatility of the price of the currency pair greatly.

For instance, the direct quote of EUR/USD is 0.7746. The trader can get 0.7746 euros in exchange for US$1. If the price increased by one pip then the new price would become 0.7747. Thus, the value of the quoted currency (USD) would rise compared to the base currency. This means that the trader can buy more euros now with the same amount of U.S. dollars.

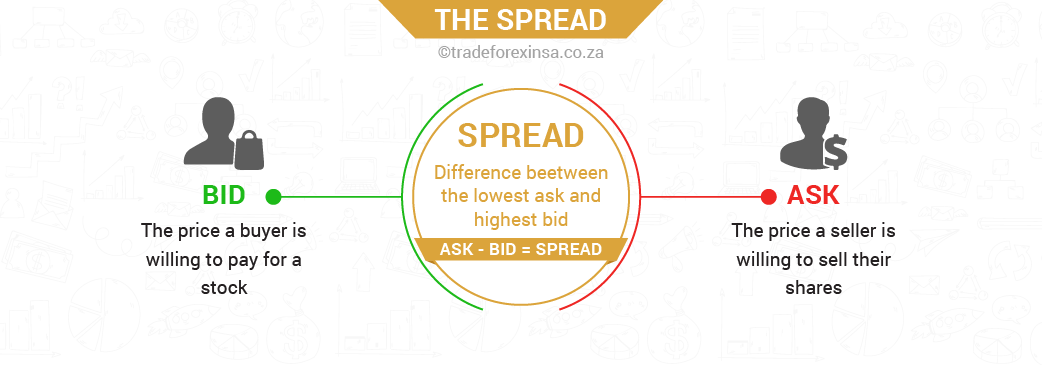

The number of euros purchased will determine the effect a one-pip change will have on the dollar amount and pip value. For example, an investor purchased 10,000 euros with U.S. dollars then, the amount paid by him will be US$12,909.88 [(1/0.7746) x 10,000]. Now, suppose there has been an increase in price by one-pip. Then, the price paid by the investor would be US$12,908.22 [(1/0.7747) x 10,000]. Therefore, the pip value for this lot of 10,000 euros is US$1.66 ($12,909.88 - $12,908.22). However, if the investor had purchased 100,000 euros at the supposed initial price then, the pip value would be US$16.6. The conclusion is that the pip value is directly proportional to the amount of the base (underlying) currency (here EUR) of the pair. The total amount of underlying currency purchased is also denoted in the trading world as lot size. The difference between the pip of the bid price and the pip of the ask price is called the spread.

What is a Forex Pipe

A Little on Spread

Spread, another jargon in the traditional currency trading market is basically the medium for the brokers to earn money. One of the reasons is that it is not recommended for the Forex brokers to charge an official commission. This is why the brokers tend to advertise that they give tighter spreads and this is just one line of competition among the brokers.

The trader can determine that he is making a profit when the trade is positive in pips, that is, the pip value is positive. If the pip calculated, as shown in this article, is negative then the trader is going to lose that particular trade.

Nowadays, some of the Forex brokers let the trades to continue in fractional pips. The fractional pips relate to much more flexibility on spreads. Thus the traders can have more control over the profits and losses.

The Spread

Reasons for Change in Pip Values

The pip value of the different currency pairs is also dependent on the base value of the trader’s account. For instance, if the account opened by the trader is USD denominated then, for the currency pairs where the U.S. dollar is the quote currency the pip value would be usually $1 on a mini lot. It has been observed that in situations where U.S. Dollar shows more than 10% up or down the pip value would change greatly. The pip value would also change is not in the currency pair like EUR/GBP. For example, the pip value of USD/JPY had changed when from 2008 to 2011 the value of USD/JPY had fallen from approximately 120 to 77.55. This shows that the pip value is not fixed and is also not the same for all currency pairs.

The trader should be extra careful about pip values when hedging as a widening spread will greatly affect both the bid and ask price. It is a risky situation and is not really recommended for the beginners. Therefore, when trading currency pairs it is essential to check that the difference in pips is as less as possible.