IC MARKETS ACCOUNT TYPES - WHAT IS THE BEST ACCOUNT FOR ME?

IC Markets is a Sydney, Australia based online trading brokerage which is carved out a positive reputation for itself over the years. Founded in 2007, the company is under the ownership of International Capital Markets PTY, headquartered in Sydney. This broker strives to provide the best trading experience to its clients by offering investment solutions that were previously limited to high net-worth individuals and investment banks. IC Markets primarily offers forex trading services with some choices of indices, commodities, and futures. An impressive aspect of this broker is the fact that it provides different account types that cater to the ever-changing preferences of the various classes of investors and traders.

IC Markets is a Sydney, Australia based online trading brokerage which is carved out a positive reputation for itself over the years. Founded in 2007, the company is under the ownership of International Capital Markets PTY, headquartered in Sydney. This broker strives to provide the best trading experience to its clients by offering investment solutions that were previously limited to high net-worth individuals and investment banks. IC Markets primarily offers forex trading services with some choices of indices, commodities, and futures. An impressive aspect of this broker is the fact that it provides different account types that cater to the ever-changing preferences of the various classes of investors and traders.

Overview:

- Minimum Deposit: 200$

- Maximum Leverage: 1:500 (T&C Apply)

- Tradable Assets: Forex, Indices, Commodities, Stocks, Bonds, Cryptos, Futures

- Regulated by FSA (Financial Services Authority), ASIC & CySec

- Demo Account: Yes

Note: Your capital is at risk

IC Market Different Account Types

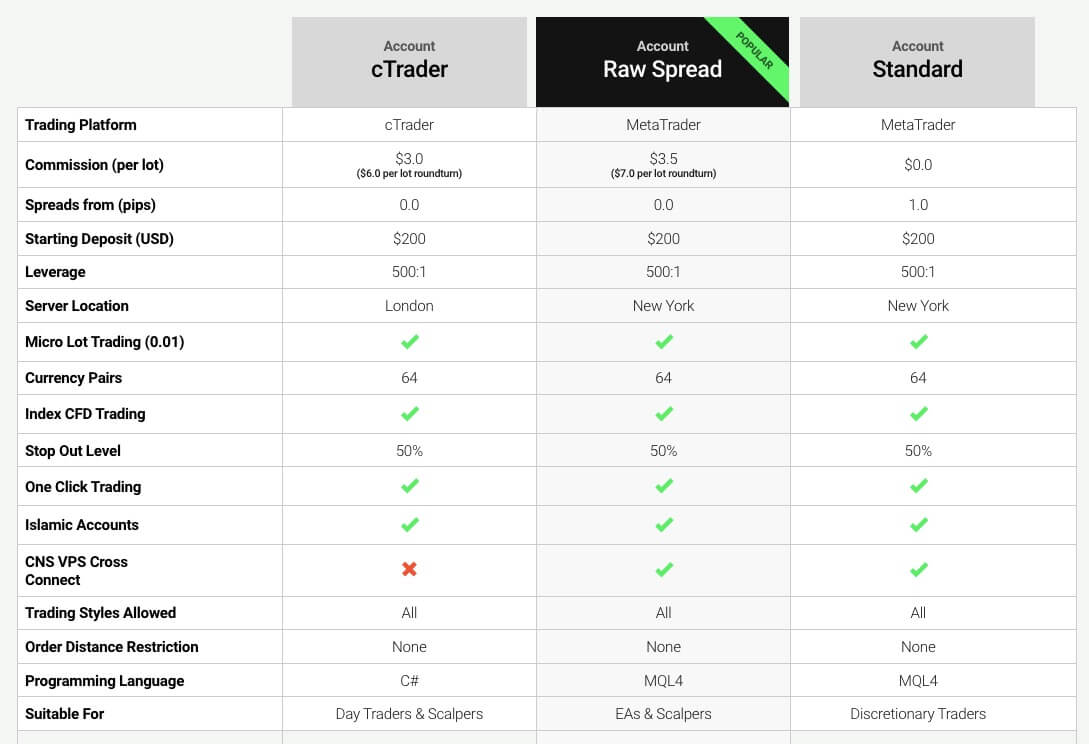

IC Markets offers three main account types which are tailor-made to suit the preferences of different traders. Users get rebates and discounts for all the accounts. The three IC Market account types are:

- An MT4 Standard Account

- An MT4 True ECN Account

- A cTrader ECN Account.

The same liquidity source or ECN is connected to all the above account types. They only differ when it comes to the trading costs incurred by the client. However, all the accounts have some common features which include one-click trading, ultra-fast order execution, no dealing desks, leverage options up to 500:1, 100% STP and compatibility with scalpers. We shall now go through the IC Market different account types individually.

IC Markets Demo Account

The demo account from IC markets provides novice traders an opportunity to trade risk–free. It provides users with virtual money, which allows one to test strategies and get a grip on how the market works. Opening a demo account is free and simple. Users just have to go to the official website and follow instructions from there.

MetaTrader 4 Standard Account

IC Market’s MetaTrader 4 account provides a very fast trade execution speed, which is complemented by very low spreads starting from 1 pip. The spread is already adjusted by deducting the IC Markets rebates of 0.3 pips beforehand. The minimum amount for opening this type of account is $200. Traders get access to a myriad of instruments including 17 CFDs inclusive of the Dow Jones Index and FTSE 100 and 60 currencies and metals. The average spread in the EUR/USD pair is 0.8 pips.

MetaTrader 4 True ECN Account

The MetaTrader 4 True ECN Account offers some of the lowest spreads available in the market, with average spreads for EUR/USD at 0.1 pips. Active day traders and scalpers should prefer this account over others, as this account has a lower commission rate. Spreads start from 0.0 pips, with a discounted commission of $5.50 per lot round turn. This account features the same amount of trading instruments as in the standard account, with a minimum account opening requirement of $200.

cTrader ECN Account

IC Market’s cTrader platform is a market-leading ECN platform, specifically focused on forex trading. There is no minimum spread on the cTrader platform, with spreads on the EUR/USD often at -0.3 pips during North American and European. It also provides a lower commission rate. The discounted commission of $2.75 per side, per 100,000 USD traded provides a perfect opportunity for traders to profit. However, the minimum account opening amount is USD 1000.

IC Markets Islamic Account

IC Markets offers Islamic accounts or swap free accounts for those whose religious beliefs do not allow them to pay interest. This swap free option is applicable on all Standard and Raw spread accounts described below on MT5, MT4, and cTrader platforms.

IC Markets Trading platform

IC Markets offers its users three high-quality trading platforms to choose from- MetaTrader 4, MetaTrader 5, and cTrader. MetaTrader 4 is the most popular platform used globally, providing clients with one-click trading solutions among other features. MetaTrader 5 is its successor and the most recent and upgraded version of the MT4 platform. The cTrader platform, on the other hand, is made exclusively for an ECN trading environment, fitted with customization options. It allows auto-trading facilities through three options: ZuluTrade, Myfxbook’s AutoTrade, and Signal Trader’s mirroring technology.

Frequently Asked Questions (FAQ)

Unfortunately, IC Markets does not accept deposits in ZAR. Clients using ZAR as their currency can either use a currency conversion service or convert their funds into any one of the accepted currencies as mentioned on IC Market’s website. Alternatively, they can use a Bitcoin Wallet, to fund their account using BTC.

ECN, STP and Market makers are the three main business models that Forex brokers use. These differ in the way transactions are handled and orders are executed. According to IC Market’s own words, the broker considers itself to be a forex provider offering the ECN pricing model. It sources its pricing from external unrelated liquidity providers after which the prices are passed on to their clients directly with no intervention from dealing desks.

IC Markets offers a seamless way to open a live account. They provide an application form after a user clicks on the “open a live account” link. After completion, the online application form is then approved by their accounts team, after which login credentials are sent to the users via their registered email.

IC Markets offers multiple ways to deposit funds into their trading account. Options include Neteller, UnionPay, Bpay, FasaPay, Poli, Bank/wire transfer, PayPal, credit card, and Skrill. They also accept deposits in ten different currencies: UD, USD, EUR, CAD, GBP, SGD, NZD, JPY, HKD, and CHF.

There is no commission on Standard accounts. However, it instead applies a spread mark-up of 1 pip above the Raw inter-bank prices that IC Markets receives from their liquidity providers. The Raw Spread account charges users a commission of $7 per standard lot round turn. Commission rates differ for different base currencies used by clients.

| AUD | 7.00 round turn |

| USD | 7.00 round turn |

| EUR | 5.50 round turn |

| GBP | 5.00 round turn |

| SGD | 9.00 round turn |

| JPY | 700.00 round turn |

| CHF | 6.60 round turn |

| NZD | 9.00 round turn |

| HKD | 54.25 round turn |

Final Thoughts

IC Markets offers a great set of trading platforms and several account options that cater to a wide range of traders and investors on a global scale. It’s fully regulated, making it one of the very few reliable brokerages offering such services in the market.

For more please read IC Markets Review

Note: Your capital is at risk